Several factors have shown that the future of payments is digital. In this sense, blockchainBlockchain is a type of database storing an immutable set of data, verifiable to anyone with access to it —through... technology is emerging as the best alternative for trading between small, medium, and large companies. Let’s take a look at the advantages of blockchain technology for business-to-business (B2B)Refers to the process by which two companies exchange goods or services. It’s very common in the cryptocurrency world. Check... services.

An overview of the B2B market

B2B payments refer to the process by which two companies exchange goods or services. Although it’s a market that goes unnoticed by most, it moves large amounts of money annually. In the United States, for example, B2B trade figures stood at $23 trillion in 2020. This is a 40% growth over 2014, according to data from Deloitte.

Despite this, researchers believe that this market is underserved, with many unmet needs that require modernization of the payments’ infrastructure. Among these problems are payment delays, high fees, fraud risks, manual processing, limited visibility of transactions, difficulties in receiving remittances, and so on.

Just as the Internet revolutionized the way we manage, consume and reproduce information, blockchain technology will change the way we do business, according to 26% of B2B users and suppliers.

Blockchain and B2B global payments

The Covid-19 pandemic didn’t impact global payments this 2021 as negatively as estimated. Indeed, global payments revenues promise to continue growing in the coming years.

This was described by researchers at the consulting firm McKinsey & Company, who believe that by 2025 there will be $2.5 trillion in global payments revenue. This is due, in part, to the fact that many private companies are adopting stablecoins, and several banks are considering the creation of Central Bank Digital Currencies (CBDCs).

However, for Deloitte, certain factors can make it difficult to process international payments under the digital infrastructure that currently exists. Thus, companies may have many invoices to process (presented in various formats), and encounter data loss in the files. They can also face a lack of administrative support to process this type of payment.

That lack is especially evident in the mid-market, which stood at more than $3 billion in 2021. Medium-sized companies, which don’t receive enough attention from financial institutions, don’t have the same budget to upgrade their international payments infrastructure as large companies would have.

Blockchain payment processors for B2B

Luckily, blockchain technology and cryptocurrencyA digital currency running on a blockchain and built with cryptography. Contrary to central-bank issued currency, cryptocurrency issuance rules are... More payment processors are much more convenient, faster, and cheaper than traditional financial solutions in the B2B sector.

Inside these new platforms, creating an account and completing the identity verification process (if applicable) can take mere minutes. Similarly, while sending money between financial institutions in different countries can take 1-5 days, using a payment processor can make the transactions immediate.

Processing the data can also become very easy. Payment processors present a summary of the transactions with all the data necessary for the company’s accounting.

The advantages of payment processors (such as ALFAcoins) for sending remittances also benefit small businesses. International trade is no longer limited to large exporters, as small businesses can find businesses that have adopted this payment technology and want to expand their market internationally.

Transparency and fraud prevention

Currently, some companies that don’t use next-generation financial technology must verify each transactionA cryptocurrency transaction is an entry on the blockchain ledger, noting sender, receiver and number of coins transacted. More manually. Also, they use payment methods that don’t provide adequate levels of security for their operations.

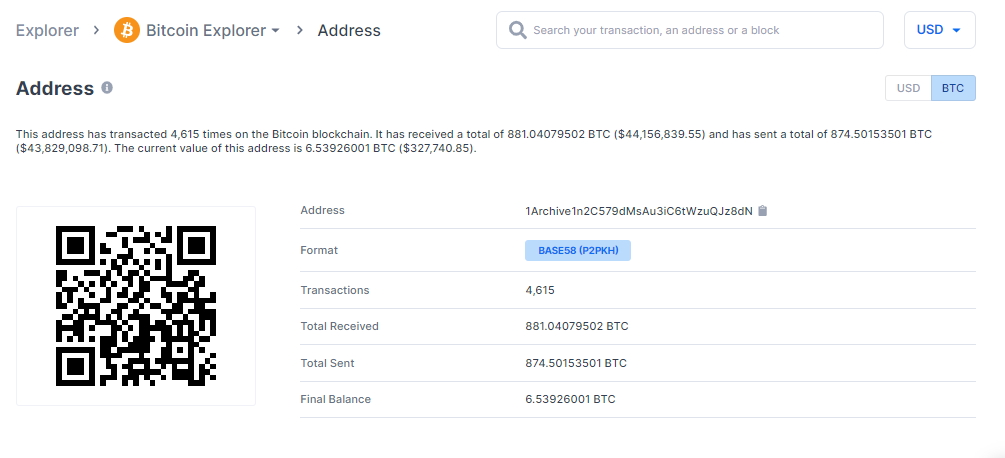

As is well known, blockchain technology is based on a digital ledgerA ledger is like a spreadsheet keeping track of which addresses own how many bitcoins. The Bitcoin blockchain is a... More distributedA distributed system is made of components that are running on different networked computers, which communicate and coordinate their actions... More inside computers around the globe. This ledger is periodically updated with each transaction. If the blockchain is public (like Bitcoin), then anyone, anywhere in the world, can consult it and verify that the data in a transaction is correct.

In the case of B2B blockchain technology for large companies, they can use a private blockchain where they process their payments. Regardless of whether they’re international payments or not, on these platforms, the transactions can be consulted only by those users who have permission to access them.

In addition, these private blockchains allow their users to make immediate transactions, without the need for strict fraud checks to verify the authenticity of the means of payment, which delays the process. The companies can make previous accords between them for this.

Payment processors also offer the security of private networks but at a lower cost. Thus, if both companies use the same processor, transaction data is usually private and protected in the database, but can be easily accessed by either party.

Non-custodial services and lower fees

DecentralizationThe transfer of control from one central entity to numerous smaller entities. Generally, cryptocurrencies are decentralized. Every crypto transaction is... More is, undoubtedly, one of the biggest advantages of blockchain technology. With this technology, large and small companies can make their transactions conveniently without using a bank as an intermediary. In this way, they can access funds immediately, reduce the costs of account maintenance fees, transfers between financial institutions, etc.

Besides, the market becomes more inclusive. More companies, regardless of their size, can interact with each other without facing the barrier of commissions and paperwork that financial entities usually require.

Another highlight of paying with cryptocurrencies is that sending B2B payments is considerably less expensive than with traditional transactions. With blockchain technology, sending payment of 10 thousand dollars, for example, has the same fee as a transaction of 15 or 10 dollars. Therefore, by paying just a one-dollar fee to move $10k, the supplier can receive the payment of a product in just minutes.

The migration from the traditional market to a new generation economy seems to be an ever-closer reality. With the regulation of stablecoins and the confidence that blockchain technology is inspiring the B2B industry, it seems that the process will happen sooner than we could imagine.

Wanna accept BitcoinBitcoin is the first decentralized digital currency. It was created in 2009, by an anonymous founder or group of founders... More and other tokens in your business or blog? You can do it safely with ALFAcoins! And don’t forget we’re talking about this and a lot of other things on our social media.

Twitter * Telegram * Instagram * Youtube * Vkontakte