Still in a bearish market, but we also had some good and interesting stories. And, of course, we already passed the famous Ethereum Merge, after years of waiting, and without anything exploding. Let’s discover the best and most important news in crypto during September 2022.

On the markets

- BitcoinBitcoin is the first decentralized digital currency. It was created in 2009, by an anonymous founder or group of founders... More (BTCAn abbreviation for Bitcoin.) lost over 4% during September [CMC]. Despite this, the firm MicroStrategy bought another 301 BTC, accumulating now 130,000 BTC (around $3.8 billion). Also, the investment management company Fidelity is considering including this coin in its brokerage accounts.

- The long-awaited Ethereum (ETH) Merge is complete now —which means no more mining on this network. Notwithstanding the milestone, the ETH price decreased by over 15% since the beginning of the month. The forked Ethereum PoW coin (ETHW) was born in the wake of The Merge but didn’t perform better. It was hacked and lost over 76% since its release on September 16.

- The exchange Binance delisted three stablecoins: USD Coin (USDC), Paxos Dollar (USDP), and True USD (TUSD). The reason behind this was only to urge the adoption of their own stablecoin, the Binance USD (BUSD). Those stablecoins are still available on other exchanges, though, including Alfacash.

- Some crypto coins performed very well during September 2022. XRP by Ripple Labs was especially remarkable, rising over 33%. Apparently, the company is gaining its legal battle against the U.S. SEC. Ravencoin (RVN) also gained attention and price (+21%), since the old Ethereum miners are migrating to this chain. Other bullish names include Chainlink (+16%), Solana (+4%), and Stellar (+2.7%).

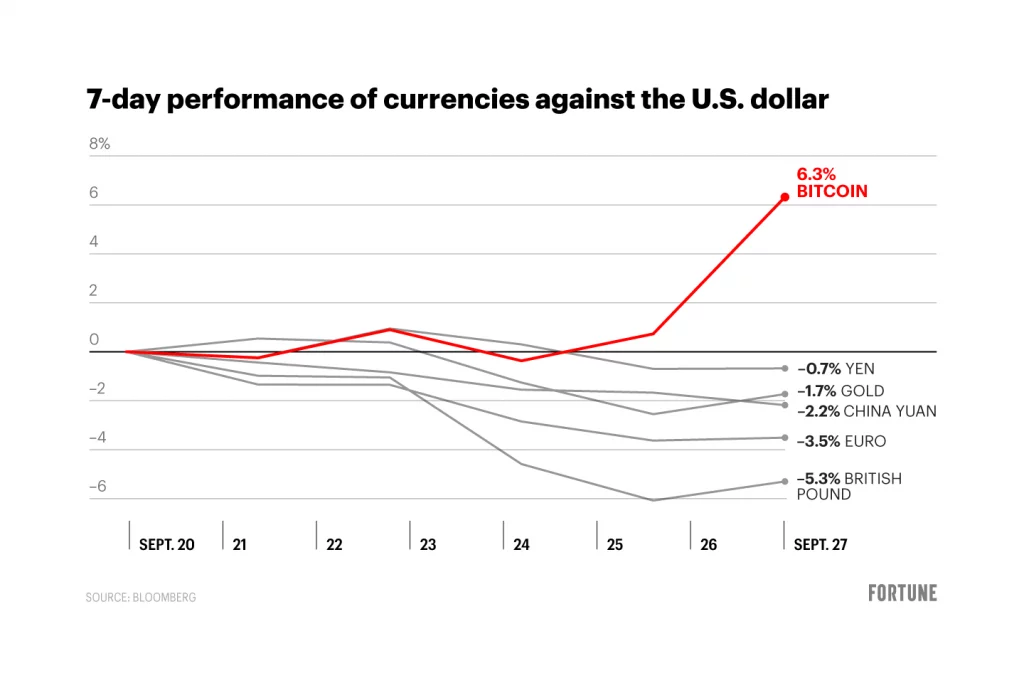

- The value of numerous fiat currencies collapsed last month: Colombian, Chilean, and Mexican pesos, rupee, euro, yen, British pound, rouble, yuan, and probably more. Several experts are talking about the end of the fiat system. Just as Fortune put it: “The world’s economy is so bad this week [year?] that Bitcoin is outperforming major currencies”.

- The Total Value Locked (TVL) in DeFi protocols decreased by 7% in the last 30 days [DeFiLlama]. Currently, the leaders by TVL are MakerDAO (+$7.2 billion), Lido DAO (+$6.06 billion), Curve (+$6.04 billion), Aave (+$5.5 billion), and Uniswap (+$5.2 billion).

Regulations on crypto

- Russia is slowly changing its hostilities against cryptocurrencies. The government is considering the use of these assets for international payments, even if supervised by their central bank. Additionally, lawmakers are preparing new regulations about it, and they expect to include Bitcoin on their national exchanges. A stablecoin pegged to the gold may come too for Russian citizens as well.

- Some Latin American countries are tightening their crypto regulations starting September 2022. It was confirmed that the Argentine Federal Administration of Public Revenues (AFIP) is legally able to seize digital wallets for debt payments, including accounts on centralized exchanges. Besides, the AFIP seized over 800 crypto mining machines only in the last month, alleging “import irregularities.”

Meanwhile, a new law to regulate cryptocurrencies was introduced to the Uruguayan Parliament. Likewise, the new Colombian government is planning a new regulation for crypto companies in the country. Not too far, in Brazil, authorities are now hunting around 28 illegal crypto exchanges. They already seized over $238 million from these fraudulent companies and individuals.

- The European law Markets in Crypto Assets (MiCA) is now finished, and it could regulate Non-Fungible Tokens (NFTs) as well. A new draft obtained by Decrypt may suggest that big and valuable NFT collections like Bored Ape Yacht Club (BAYC) or CryptoPunks may count as securities, so, they would be regulated as it. This is only a legal opinion yet, though.

- The U.S. SEC is going to open an office specializing in crypto assets, aimed to supervise crypto companies. Besides, they’re threatening to regulate the new PoS Ethereum as a security, since staking looks “similar” to lending for them. In the meantime, the White House already issued a regulatory framework for cryptocurrencies, urging to protect the investors by placing “aggressive” actions against “unlawful practices in the digital assets space”.

Hacks and security

- In September 2022, around 24 crypto DeFi platforms were attacked or committed scams, leading to losses of over $167.9 million in total [DeFiYield]. From that total, $160 million were stolen in 90 different assets from the protocol Wintermute, in which private keys were compromised. However, again, the most affected blockchainBlockchain is a type of database storing an immutable set of data, verifiable to anyone with access to it —through... was Binance Smart Chain (BSC).

- Crypto scammers are taking advantage of the iPhone 14 release in September 2022. They’re publishing fraudulent videos on YouTube about it, talking about “special events” for the release, including fake crypto airdrops and links to malicious crypto exchanges. They’re also hacking Metaverse-related social media accounts to lead to phishing sites and steal the users’ information —like private keys.

- A new and dangerous malware dubbed “Erbium” can steal confidential information, including passwords and cryptocurrency wallets. It’s being spread through phishing, malicious advertising, and infected files (like non-official game downloads). Besides, anyone can buy it from the Darknet and distribute it by themselves.

- South Korean authorities have indicated that Interpol issued a “Red Notice” for Do Kwon, founder of Terraform Labs (UST and LUNA). This would imply that Kwon would be wanted for his arrest and extradition by 195 countries. However, he doesn’t appear on the public “Red Notice” list by Interpol, and he denied being on the run. In any case, prosecutors from his native country are aiming to freeze $60 million in Bitcoin linked to him.

Other news

- After the Ethereum Merge in September 2022, the old crypto ETH miners migrated to several networks, instead of disconnecting their machines. After an initial (and quickly lost) interest in Ethereum Classic (ETC), miners decided to put their efforts into more profitable chains like Neoxa (NEOX), Ravencoin (RVN), Ubiq (UBQ), and Beam (BEAM).

- Starbucks and Walmart are going to the Metaverse. The first company is preparing a loyalty program with NFTs and a web3 space, while the second one already developed two immersive experiences on Roblox: Walmart Land and Walmart’s Universe of Play. In both cases, the users will be able to find rewards for participating.

- Not only the prices are being affected by the bear market. According to data by Artemis, the number of weekly active developers compromised on the crypto space decreased by over 14% during the last three months. Among the most affected chains by this “dev runaway” are Polygon, Cardano, Celo, Binance Smart Chain, Polkadot, and EOS.

- Last September 15, 2022, was the deadline to make or update claims about the crypto Mt. Gox case, so, it’s believed that the repayments for the old investors could start soon. However, the known Bitcoin addresses held by the Mt. Gox trustee still don’t have any recent movements. That distribution could take months and more legal battles, even.

Wanna trade BTC, ETH, ADA, and other tokens? You can do it safely on Alfacash! And don’t forget we’re talking about this and many other things on our social media.

Telegram * Facebook * Instagram * YouTube *Twitter