We’re having an unusually stable month for BitcoinBitcoin is the first decentralized digital currency. It was created in 2009, by an anonymous founder or group of founders... More (BTCAn abbreviation for Bitcoin.) and cryptocurrencies. The first asset barely varied between $18,300 and $20,400 during the last 30 days, not to mention it has found a middle point at +$19,000 since mid-October [CMC]. At first glance, an upcoming bullish period doesn’t seem evident, but, according to several experts and charts, the Bitcoin price could rally again very soon.

As indicated by Ki Young Ju, CEO of the analytics firm CryptoQuant, the whales (rich wallets) are accumulating more and more Bitcoin lately. He’s not alone with this data. Glassnode has discovered a huge BTC supply going out from the exchanges to non-custodial wallets, which means that the holders are refusing to sell in the short term.

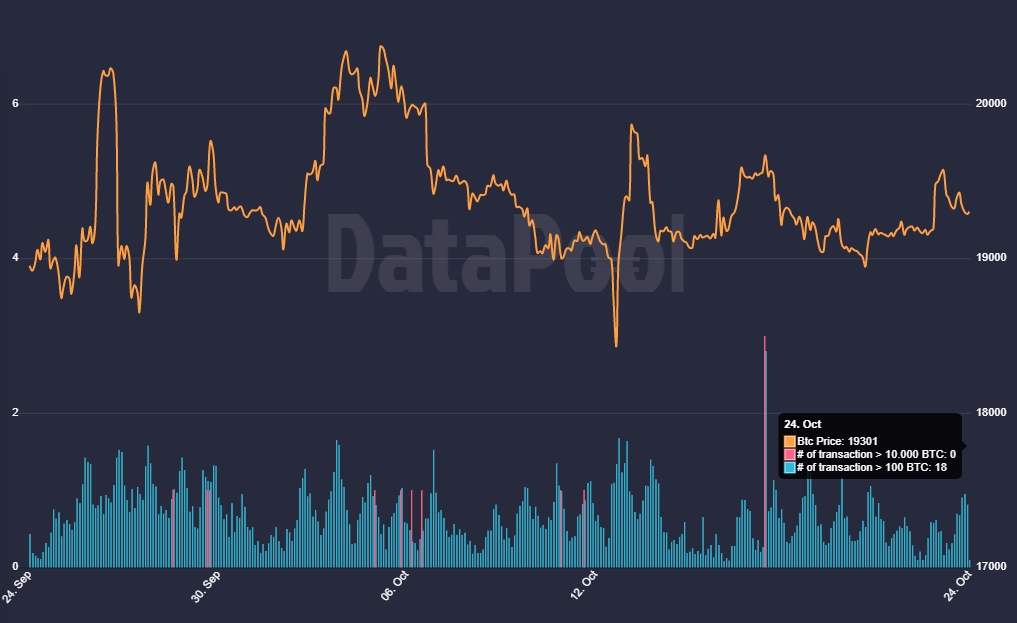

Likewise, the Whale Stats on DataPool shows us a sharp decrease in on-chain transactions by Bitcoin whales in the last month. They went from 81 daily transactions of over 100 BTC to barely 18 during the same period (-77%). This could imply that they’re holding and accumulating more coins, waiting for the bullish market.

Other crypto analysts, like Michaël van de Poppe, Il Capo of Crypto, Plan B, and @filbfilb (DecenTrader founder) are pointing to another Bitcoin rally for this year. Beyond them, for the CEO of Ark Investment, Cathie Wood, the total market capitalization of Bitcoin could rise more than anyone expects during the next years. It could even hit $4.5 trillion, which, with a supply of 21 million coins, would be equivalent to a price of over $214,000 per coin. The latter without counting all the lost coins until the time being.

Currently, Bitcoin sits at $19,360 with a market cap of $371.4 billion. That’s a monthly increase of over 2%.

More investment is coming for a Bitcoin rally

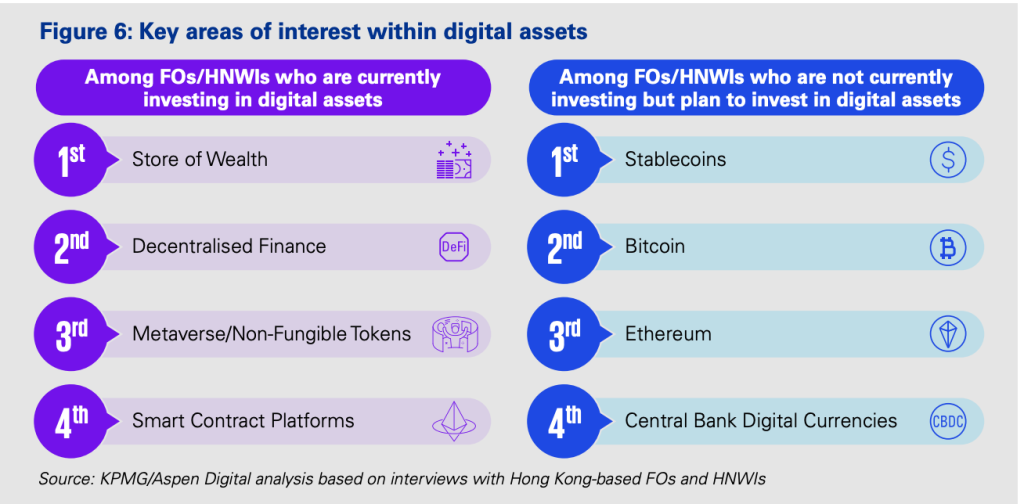

Not only the analysts are talking about this matter. A recent survey released by KPMG China and Aspen Digital revealed that around 92% of its wealthy participants are interested in cryptocurrencyA digital currency running on a blockchain and built with cryptography. Contrary to central-bank issued currency, cryptocurrency issuance rules are... More investments. The mentioned companies surveyed at least 30 Family Offices (FO – legal entities established by millionaire families to manage their wealth) and high net-worth individuals (HNWIs) in Asia during the second quarter of the year.

Around 61% of them have assets under management between $10 to $500 million, while 12% managed even more. So, they could easily become new whales for Bitcoin and cryptos. Indeed, 58% of respondents are already investing in stablecoins, Bitcoin and Ethereum.

Meanwhile, the asset management firm Fidelity is looking to expand its crypto division with 100 employees more. In the same vein, companies like the New York Digital Currency Group (NYDIG), Mastercard, and Google are buying Bitcoin or building new products related to it. We could, indeed, enjoy a Bitcoin rally before the year ends.

Wanna trade BTC, ETH, and other tokens? You can do it safely on Alfacash! And don’t forget we’re talking about this and many other things on our social media.

Telegram * Facebook * Instagram * YouTube *Twitter