If you’re a beginner in crypto, this is super important information. Sometimes, you may think you’re buying “BitcoinBitcoin is the first decentralized digital currency. It was created in 2009, by an anonymous founder or group of founders... More” just because the token (or even the service/platform) has that name. But that’s not always the case. Bitcoin doesn’t have a proper copyright. On the contrary, it’s open-source software and its name is public. Anyone can copy it and use the word “Bitcoin” —resulting in numerous types and names.

As a consequence, we have not one, not two, or three, but over 100 tokens sharing the same name (Bitcoin) with some additions or slight changes [CMC]. Some of them are directly-forked coins (cloned from the original code), some others are entirely different altcoins with additional functions, and we also have assets anchored to the Bitcoin price. And scams. Sadly, we have scams as well.

It’s essential, then, to learn the distinction between the “original” Bitcoin from the other tokens with the same name. Let’s explore a bit about them.

Most popular Bitcoin “types”: Cash, SV, and Gold

Beyond the classical Bitcoin (BTCAn abbreviation for Bitcoin.), we have three main altcoins with the name. By market capitalization, they are Bitcoin Cash (BCH), Bitcoin SV (BSV), and Bitcoin Gold (BTG). None of them is the original Bitcoin. They have their own systems, prices, developers, and community.

Bitcoin Cash was the first direct BTC hardfork, back in 2017. It was created to increase the BTC size blockA collection of cryptocurrency transactions. Every few minutes (or seconds, depending on the blockchain) one miner or validator verifies the... More and avoid the feature SegWit, but, otherwise, the system is identical to the original. However, their supporters are other people. They include the entrepreneur Roger Ver and the mining pool ViaBTC. For a while after its creation, they made an aggressive campaign to promote Bitcoin Cash (BCH) as the “real” Bitcoin, against BTC. It wasn’t very successful, though.

Today, BCH has a market cap of $2.5 billion and a price of $133 per unit [CMC]. In 2018, the Australian businessman Craig Wright, auto-proclaimed Satoshi Nakamoto, partnered with the billionaire Calvin Ayre to fork Bitcoin Satoshi’s Vision (BSV) from Bitcoin Cash. He previously supported BCH, but the whole team had disagreements again and took separate ways (and chains).

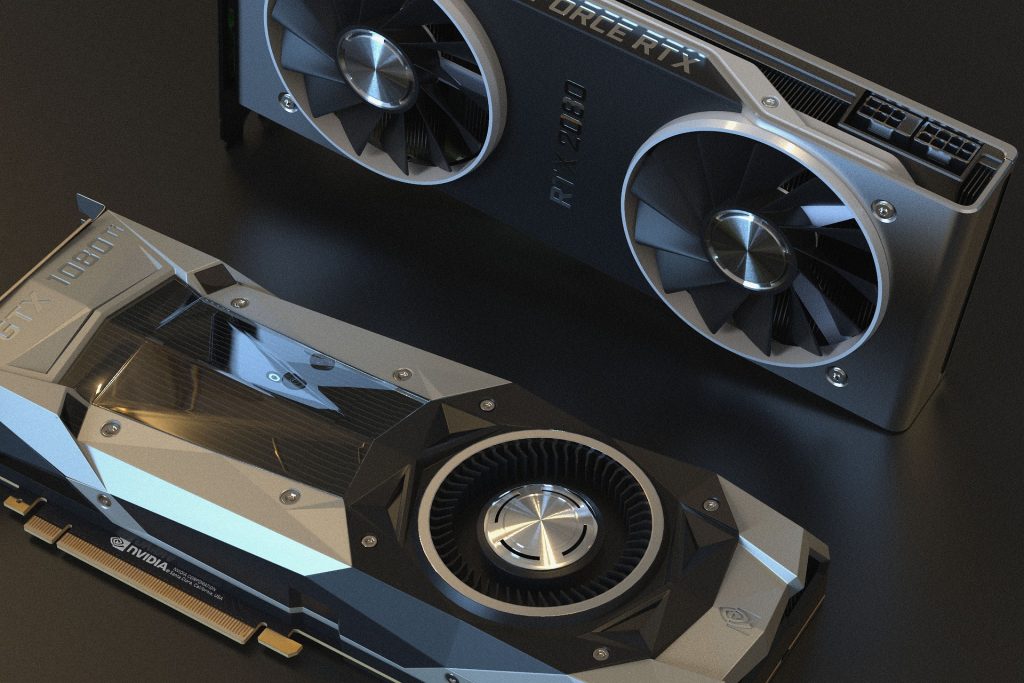

Now, BSV (a different altcoin) has a market cap of $863 million and a price of $44.8 per unit. Finally, we have Bitcoin Gold (BTG). This is also a forked coin from BTC, in existence since 2017. Its ‘raison d’être’ was to change the original system to ban the expensive mining with specialized machines (ASICs). Instead, anyone with a graphic card could mine BTG.

Bitcoin Gold currently has a market cap of $294 million and a price of $16 per unit. As we can see, none of the Bitcoin names above can yet compare its numbers to the original BTC. The latter has a market cap of $441 billion and a price of around $23,000 per unit [CMC].

Other widely used Bitcoin names: Wrapped, BEP2, and RBTC

Other Bitcoin-named tokens, contrary to BCH and similar altcoins, don’t pretend to compete against the original BTC. Instead, they were built to be representations of the first cryptocurrencyA digital currency running on a blockchain and built with cryptography. Contrary to central-bank issued currency, cryptocurrency issuance rules are... More in different blockchains. In a similar fashion to a stablecoin, they’re pegged to the Bitcoin price at a 1:1 ratio (more or less). They’re not “Bitcoin”, but they’re equivalent assets outside that system.

Let’s remember that every blockchain is a different platform, with no native communication between them. That’s why the Wrapped Tokens were created. You can’t use “BTC” inside Ethereum or BNB Chain, for example, because they’re independent chains with their own native assets. But you can acquire an equivalent token in price: a Wrapped Bitcoin (WBTC — on Ethereum) or a Bitcoin BEP2 (BTCB —on BNB).

That’s the same case for the sidechain RSK. They have the token Smart Bitcoin (RBTC), pegged to the BTC value. It’s their native asset for transactionA cryptocurrency transaction is an entry on the blockchain ledger, noting sender, receiver and number of coins transacted. More fees and smart contracts execution, but again, isn’t BTC. All these Bitcoin “types” must have collateral in BTC behind them. If that fails, if their native networks fail, they could lose their value. They couldn’t be sold as original BTC.

Besides, their market capitalizations are also different from the original BTC. WBTC has a market cap of $4.1 billion, BTCB has $1.2 billion, and RBTC has $79.8 million. The price also varies a bit: WBTC is at $22,940, BTCB is at $22,970, and RBTC is at $22,851 [CMC]. The Bitcoin names could be crucial to the price, after all.

Bitcoin scams

We already talked about altcoins and wrapped tokens. Now it’s time for the scams: fake services, websites, wallets, and platforms that take the Bitcoin names to deceive (and rob) people. A great example of this is the scam network Bitcoin Evolution. Also known as many other “Bitcoin + last name”, like Bitcoin Revolution, Bitcoin Time, Bitcoin Trader, Bitcoin Future, Bitcoin Superstar, Bitcoin Lifestyle, Bitcoin Era, Bitcoin Storm, Bitcoin Loophole, Bitcoin Billionaire, Bitcoin Norway, etc.

They usually attract users through social media, with fake articles about famous people investing in their platform and becoming rich overnight. Then, they ask for a minimum investment of $250 and promise to multiply it with automatic trading or other investments. Of course, they never do that. They just steal the money and change their domain when it’s scammed enough individuals.

In these cases, the victims could say they “invested” in Bitcoin, but that’s not true. They never had any coin at all, indeed. They just deposited fiat money into a dubious website, which happened to use the name of Bitcoin for malicious purposes. Bitcoin is a decentralized cryptocurrency, and, if you really own some coins, you should have your own private keys.

Check what you’re buying!

The crypto industry involves a lot of money and communities, so, it could be easy for a beginner to get lost. With the increasing number of Bitcoin types and names, getting confused seems more likely. But there’s some data you can check before buying any token, to make sure you’re in the right place.

- The ticker (abbreviation) is essential. The original Bitcoin only has two accepted tickers: BTC and XBT. If this changes, then you’re buying another token.

- The logo could be used by anyone, everywhere, but it could still be a good indicator (if it’s not a scam). Altcoins like Bitcoin Cash, Bitcoin SV, Bitcoin Gold, Bitcoin Diamond, or Bitcoin Private always have different logos than the original BTC.

- If you’re not operating on the Bitcoin blockchainBlockchain is a type of database storing an immutable set of data, verifiable to anyone with access to it —through..., but in others like Ethereum, BNB, or RSK; then you’re using a wrapped token, and not the original BTC.

- The market cap is a tell-tale sign, more than the price. A wrapped token could show the same BTC price, but never the same market cap. It’s the same case for altcoins. If it doesn’t even have a market cap, then you’re not using a cryptocurrency.

- If you’re technical-wise, you can check the underlying code of the coin and compare it with the BTC whitepaper. The developers usually share it on the official webpage of their products.

- Use sites like CoinMarketCap (CMC), CoinGecko, and CryptoSlate to check coin rankings (and Bitcoin types) with their respective tickers, market caps, prices, webpages, exchanges, and more.

Wanna trade BTC, BCH, and other tokens? You can do it safely on Alfacash! And don’t forget we’re talking about this and many other things on our social media.

Telegram * Facebook * Instagram * YouTube *Twitter