The name seems to say everything about it: stablecoins. They’re crypto coins with a stable price all the time… or, at least, that’s the intention. Sadly, it doesn’t always work. There are around numerous failed stablecoins so far, and, likely, there will be even more in the upcoming years. Tether (USDT) and USD Coin (USDC) are the leading stablecoins now, with billions invested in them. What’s their future?

We can’t know for sure, but we can make some good guesses with the data we already have. They both have pros and cons, and history has shown us bad and good examples of عملات مستقرة. Let’s explore that a bit.

The Terra (LUNA) case

We can’t avoid the infamous Terra (LUNA) and TerraUSD (UST) case, since it’s been the most awful crash in the stablecoin world. If you’re new to crypto or have been living under a rock, you must know that the blockchain Terra held the third biggest stablecoin (UST) available until April this year.

By that moment, the market cap of UST was above $17.9 billion [CMC]. LUNA, its governance counterpart, enjoyed a price of $96 per token and a market cap of over $33.8 billion. It was the eighth cryptocurrency by market capitalization. UST used LUNA coins to keep its 1 USD peg, instead of reserves.

As they explained, “TerraUSD is an algorithmic stablecoin, where the cost of minting is equal to the face value of the stablecoins minted — to mint 1 TerraUSD, only $1 worth of the reserve asset ($LUNA) must be burned.” In other words, UST kept its 1 USD value by issuing and burning LUNA coins. Until May 8, 2022. They were big, so, the fall was deadly.

After a day full of short positions and the market panicking, UST lost its peg. By May 14, UST was at $0.1 (90% less) and now it doesn’t exist anymore. LUNA was dragged into the deadly spiral, losing almost all of its value. Bottom line: UST and LUNA had more sales pressure than they could handle. The investors lost trust in a system that previously worked, and UST quickly joined the list of failed stablecoins.

The team behind Terra tried to revive the chain with a hardfork, resulting in Terra Classic (LUNC) —not a stablecoin. However, this coin is barely at $0.00024, and its market cap is $1.6 billion. Numerous retail investors lost their life savings to this, so, the trust hasn’t been recovered.

More failed stablecoins

TerraUSD hasn’t been the only failed stablecoin, and it’s not even the first one. The first stablecoins popped into existence around 2014, trying to achieve a much-needed source of price stability inside the cryptocurrency world. Most of them didn’t apply the backup reserves to keep their prices, though. Instead, they were just like UST, of the algorithmic type —which means they relied on their code and supply to be “stable”.

وفق CryptoSec, there’s been at least 23 failed stablecoins so far. We can add up those to the current +134 alive stablecoins available on the markets [CMC]. In comparison, the failures seem to be a small percentage. But the market must learn from past mistakes if we want to grow further.

Among the most (previously) popular failed stablecoins, we can mention NuBits (2014), bitUSD (2014), Basis Cash (2018), Iron Finance (2021), BeanStalk (2021), and, more recently, Acala USD (2022). The reasons behind their failures include big hacks, regulatory issues, or simply a lack of trust by their users. They didn’t seem to have enough monetary reserves, legal compliance, or community support to survive the hits of the crypto market.

Tether issues

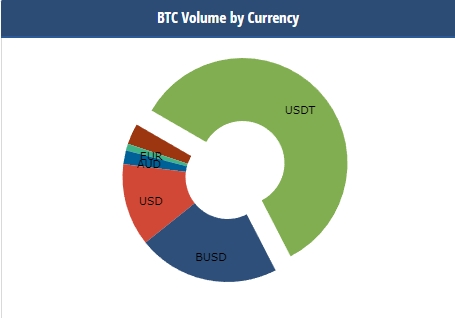

Currently, Tether (USDT) is the queen of stablecoins. It has a market cap of over $68.5 billion and is the third coin by this factor [CMC], only behind Ethereum (ETH), and Bitcoin (BTC). As indicated by مقارنة التشفير, USDT is the most traded coin against BTC, even more than USD. Therefore, it’s understandable that any issue around this coin cause concern.

The New York Times even dubbed it “The Coin That Could Wreck Crypto” —and with reasons. Back in May, when Terra (LUNA) crashed, the whole crypto market crashed as well (temporarily, though). And it wasn’t as big as USDT. The truth is that the hypothetical Tether fall could cause a pretty bad domino effect on the crypto market and beyond. You can’t erase $68 billion from markets and expect no consequences.

A least, we can say that USDT has been very strong in two points: legal compliance and community support. Tether Limited, the company behind this stablecoin, has collaborated with authorities even when accused of wrongdoing. They’ve paid almost $60 million in fines to US authorities, which are constantly worried about their reserves.

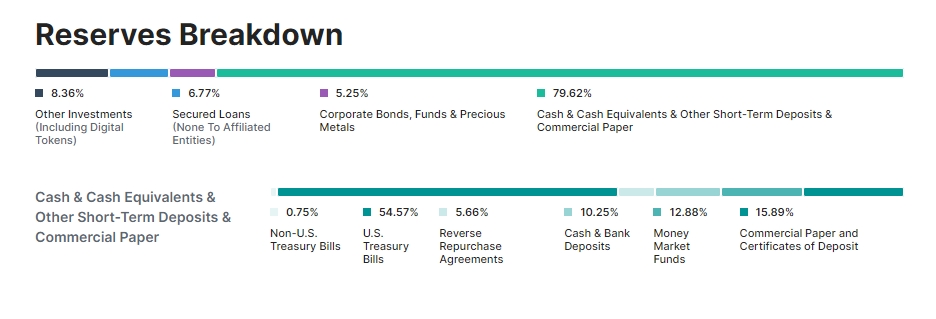

That’s probably the main problem with USDT. At first, its creators claimed that it was “fully backed” by USD cash on bank accounts owned by the company. However, this isn’t the case now. If we check their Reserves Breakdown, we’ll notice right away that most of their assets aren’t liquid enough.

Only 10.25% are cash and bank deposits. The remaining percentage is formed by cash equivalents and other short-term deposits, commercial paper, secured loans, corporate bonds, funds, precious metals, and other investments —including other not-specified digital currencies.

USDC issues

USD Coin (USDC) is barely behind Tether in market cap, with over $43.8 billion. It was launched in 2018 by the US company Circle, which claims to be fully regulated. A factor to prefer this coin over USDT could be their reserves and transparency. As it reads on their الموقع الرسمي:

“Known as a fully-reserved stablecoin, every digital dollar of USDC on the internet is 100% backed by cash and short-dated U.S. treasuries, so that it’s always redeemable 1:1 for U.S. dollars (…) Circle is regulated as a licensed money transmitter under U.S. state law (…) Circle’s financial statements are audited annually and subject to review by the SEC.”

Not everybody believes this, though. The trader Geralt Davidson revealed a popular theory against USDC in June, claiming that it would crash sooner or later. According to his theory, Circle has been hiding billionaire losses and diminishing its reserves. Thus, they wouldn’t be able to handle a massive sell-off like the one suffered by Terra.

Of course, this is only a theory. A confirmed fact that could put USDC in trouble is its competition against Binance USD (BUSD). Just recently, Binance delisted three stablecoins, including USDC. But that’s not all. They did it to enforce the adoption of their own stablecoin, BUSD. For some users, this is considered a flagrant attack on USDC and a massive hit on its markets, given that Binance’s ecosystem is a billionaire place.

Not decentralized

Another factor we must consider about USDT and USDC is their centralization. The coins are fully controlled by their parent companies, which are at the whim of their owners and the authorities. Unlike other cryptocurrencies, they’re not لامركزية at all, and the community has little to no control whatsoever over them. The companies can even freeze assets if they want to do so.

Circle, indeed, was very criticized for freezing 75,000 USDC in user funds linked with the sanctioned mixer Tornado Cash. If you think about it, it couldn’t be any other way for them. The Circle HQ is in Boston, Massachusetts (US). However, we can say that Tether Limited is owned by the Hong Kong-based company iFinex Inc., which also owns the Bitfinex cryptocurrency exchange.

Can Tether and USDC join the failed stablecoins?

As a short answer: yes. But, at this point, even the USD can join the failed stablecoins. Now, is it probable? Likely not. Of course, both USDT and USDC have their own issues to deal with, but, so far, they’ve done it nicely. Tether has survived hit after hit, either from regulators, hackers (if we count the Bitfinex hack), or the market itself.

Last June, for example, panicked investors pulled $1.6 billion out of this coin in only two days. But the USDT version of losing its peg it’s decreasing to $0.99 per token. The same happens with USDC: its All-Time Low was three years ago, at $0.92 per coin [CMC]. However, we can say that the blow by Binance took some effect since its market cap has decreased by 15% since the announcement. It’s not a deadly spiral, though.

Now, the great question is: were all the failed stablecoins of the algorithmic type? USDC and USDT are certainly not. But the answer, again, is no, not every failed stablecoin was algorithmic. Not even UST was fully algorithmic: the team also had a billionaire collateral في Bitcoin (BTC). Although, in the end, that didn’t work to save it. Bank runs also happen with fiat currencies, and, sometimes, they’re inevitable.

That’s exactly where regulators make their appearance. For instance, the next European framework Markets in Crypto Assets (MiCA) could seriously limit the activity of big stablecoins like USDC and USDT, while completely banning the algorithmic stablecoins. Other regions worldwide could follow this example. So, maybe the answer isn’t exactly that they’ll fail, but surely, they’ll be much more limited and controlled.

Wanna trade USDT, USDC, BTC, and other tokens? You can do it بأمان على Alfacash! ولا تنس أننا نتحدث عن هذا والكثير من الأشياء الأخرى على وسائل التواصل الاجتماعي الخاصة بنا.

برقية * موقع التواصل الاجتماعي الفيسبوك * انستغرام * موقع YouTube *تويتر