Mistrust has led to the testing of reserves and liquidity of crypto exchanges becoming crucial. Therefore, US regulators consider it imperative to advance statutes that protect consumers against events such as the collapse of FTX.

US regulators investigate FTX

رويترز ذكرت that the Department of Justice, the Securities and Exchange Commission (SEC), and the US Commodity Futures Trading Commission are investigating how FTX handled client funds.

The regulators’ investigation also targets FTX executives and any possible breaches they have made of securities laws.

For the vice president of the Federal Reserve, Lael Brainard, the crypto sector has proven to be susceptible to the same risks as traditional finance. Thus, it should be subject to the same rules.

Likewise, Senators Debbie Stabenow and John Boozman معلن that publishing the final version of the Digital Commodities Consumer Protection (DCCPA) is imperative. In their opinion, the crypto-assets industry requires ampler federal supervision to give consumers confidence that their investments are safe.

If this bill becomes law, the Commodity Futures Trading Commission (CFTC) will win an extension of regulatory powers over the cryptocurrency industry. The DCCPA is a bill that officially reached the US Congress on August 3, 2022.

Crypto.com could be in the eye of the storm

Crypto.com, OKX, بينانس, Huobi, and Gate.io, are some of the centralized exchanges that have stated that they want to regain the trust of the crypto community. To achieve this, they have published details of their reserves.

Unfortunately, Crypto.com users found concerns in the exchange’s reserve statement. They noted that there are some troubling parallels between Crypto.com and FTX.

Among them are multimillion-dollar expenses in marketing campaigns. Also, it highlights the acquisition of the naming rights for an arena of the professional basketball league in the United States, the NBA.

Likewise, its CRO token has lost more than 93% of its value since its ATH on November 24, 2021 [CoinMarketCap]. This loss in value is eerily reminiscent that the FTX debacle began with the crash of its FTT token.

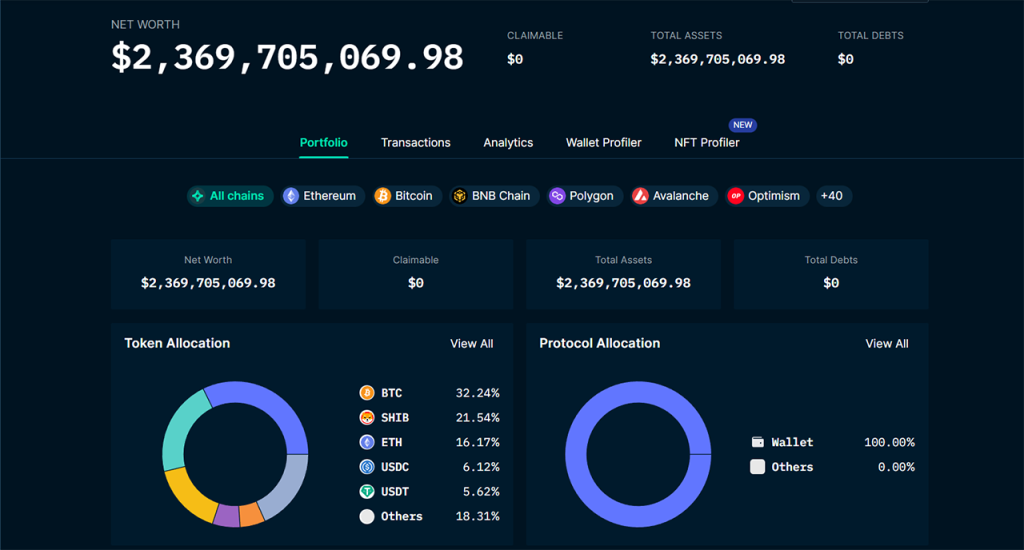

Another point that worried users are that only 10% of Crypto.com’s $2 billion reserves are in USDT and USDC stablecoins.

Furthermore, more than 20% of all reserves are held in شبعا اينو (SHIB), a highly volatile meme coin. Similarly, about 30% of the funds are in the native token’s platform.

But, there is no proof that Crypto.com has invested money from its users in risky assets like FTX did, and regulators have yet to speak out on the matter.

At the same time, Binance exchange created a fund to rescue companies affected by the collapse of FTX. BlockFi, Multicoin, and Genesis Capital are some of the companies concerned.

DEX trade soars

While regulators raised their alarms over the FTX collapse, users have already started migrating to decentralized exchanges (DEX). So, amid the turbulence, the daily volume traded on DEX raised this Monday above 600% [CoinMarketCap]. This shows that investors are betting on decentralization, at least temporarily.

Wanna trade BTC, DOGE, and other tokens? You can do it بأمان على Alfacash! And don’t forget we’re talking about this and many other things on our social media.

برقية * موقع التواصل الاجتماعي الفيسبوك * انستغرام * موقع YouTube *تويتر