The last years haven’t been stable for most Bitcoin miners worldwide. Since its beginning, Bitcoin (BTC) found an epicenter in China, and the miners weren’t an exception to this. However, the government in the Asiatic giant didn’t let the cryptocurrencies thrive on their territory. They made everything possible to exile these decentralized assets from their country.

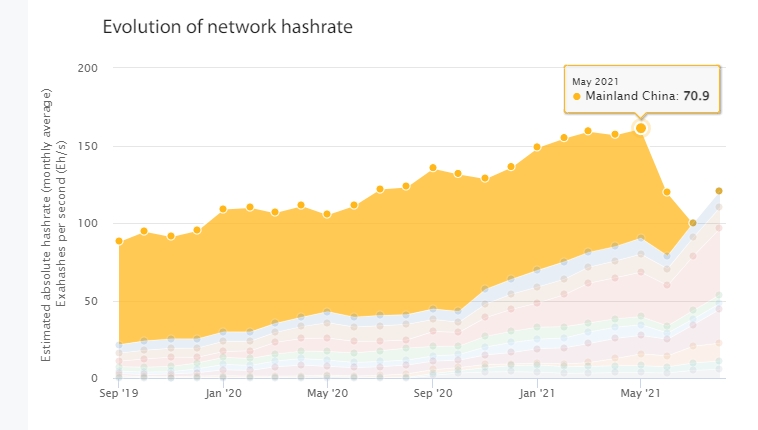

For 2020, according to the Těžařská mapa Bitcoin by Cambridge, China accounted for 65% of the total BTC hashrate (mining power). That was probably because of the large amount of energy (necessary for těžba kryptoměn) available at low prices. Likewise, the Internet speed is over 172 MB/s, and the miners could enjoy cold winters for cooling down the machines. The regulations were never crypto-friendly, though.

Podle September 2021, China finally decided to fully ban cryptocurrencies and all their related activities —including, of course, Bitcoin mining. A massive exodus of miners followed. They chose several countries as a destiny, some of them very close to China, and some others far away.

According to the same Bitcoin Mining Map, by July 2021, five countries shared the main portion of Bitcoin hashrate: Russia, United States, Malaysia, Iran, and Kazakhstan. So, are the Bitcoin miners still there in 2022?

Bitcoin miners in Asia and Russia —for now

Russia and Kazakhstan are very close to China, and both of them have favorable conditions for miners (i.e., great energy production, good Internet connection, and cold weather). The logical result is that they’re now Bitcoin mining epicenters, but not everything’s fine about it. None of these countries have shown a friendly attitude towards cryptocurrencies, despite they don’t really have a ban over them.

It’s something that’s been considered by Russia, though. Luckily, the idea didn’t crystalize, and now there’s a crypto-related bill waiting for approval. To summarize: crypto payments are banned, but the citizens can still buy, hold, and sell cryptos as an investment tool after being properly identified by a national bank. The Bitcoin mining isn’t specified, but higher taxes are expected. At least, a full ban seems out of the table now.

The circumstances aren’t that hopeful in Kazakhstan and Iran. Bitcoin started 2022 with a crash in its hashrate, and that was mainly because of the first country. The political turmoil there caused the government to cut off power and the Internet, necessary for the miners to work. By the end of January, Kazakhstan declared an energy crisis and temporarily cut off power for crypto miners.

The worst part is that leaving is a difficult option as well, as declared Alex Brammer, from the mining company Luxor Tech. Other countries, like Russia, Canada, or United States have a shortage of adequate facilities for more miners at this point. So, they’re “stuck” for now. Probably, it’s the same for the Iran miners.

Iran and Malaysia

Despite providing over 1,000 official licenses to Bitcoin miners, Iran banned this same activity twice in 2021. Also alleging an energy crisis during winter, Bitcoin mining is now banned in the nation until March 2022. Additionally, they’re preparing new laws for crypto, intending to properly regulate it “as soon as possible”. In the best of cases, this country has proved very unstable for crypto mining.

For its part, the government in Malaysia has become an expert in seizing non-authorized mining farms nationwide. According to Bukit Aman Criminal Investigation Department (CID), over $13 million worth of crypto and mining machines were seized in this country during 2021. They even used a steamroller to destroy 1,069 bitcoin mining rigs.

The current regulations aren’t very favorable either. In Malaysia, cryptocurrencies are declared non-legal tender nor a payment instrument, and they’re mostly considered securities. The trading is legal, though. This, along with the abundance of energy, could make a great portion of Bitcoin miners ask for licenses and stay in the country —if the předpisy don’t turn against them.

United States to the future

We can say that the U.S. has been crypto-friendly, but includes proper regulations for every related activity. So far, Arizona and California have asked to make Bitcoin legal tender; while other jurisdictions, like Florida and Texas, have had energy abundance and crypto-friendly regulations since several years ago.

This doesn’t mean that everything’s perfect there. For now, indeed, several companies and mining farms had to power down their operations due to strong storms, since they don’t want to affect the community by taking all the energy in the dead of winter. That’s something temporary, though. What could really affect them long-term is the upcoming regulations.

The U.S. government is aiming for tighter crypto regulations in 2022, počínaje únorem. As for crypto mining, they’re planning to make it greener. On the other hand, the taxes will depend on the state: for example, Kentucky has tax incentives for Bitcoin miners. So, despite the possible obstacles, the United States is now považováno the new “Bitcoin mining capital of the world”. That probably won’t change that much in the upcoming years.

Latin America potential

We should mention El Salvador (Central America) as an attractive destiny for Bitcoin miners. This is the first country with Bitcoin as legal tender, and they also have abundant geothermal energy. Indeed, the government is using that energy to mine Bitcoin already.

And this isn’t the only country in this region to have the potential for Bitcoin miners. Paraguay is about to approve a law to protect Bitcoin miners and let them use the clean energy they have. Costa Rica also offers clean, abundant, and cheap energy; and it’s welcoming the Bitcoin miners. Argentina has been another popular destiny, even if the energy costs zvednutý recently.

For its part, despite the political turmoil and power cuts, Venezuela is still the cheaper (and profitable) country for Bitcoin miners. The government probably knows this, because they just applied a new tax scheme to take 2-20% from transactions in crypto and foreign currencies.

“Other” is a popular option

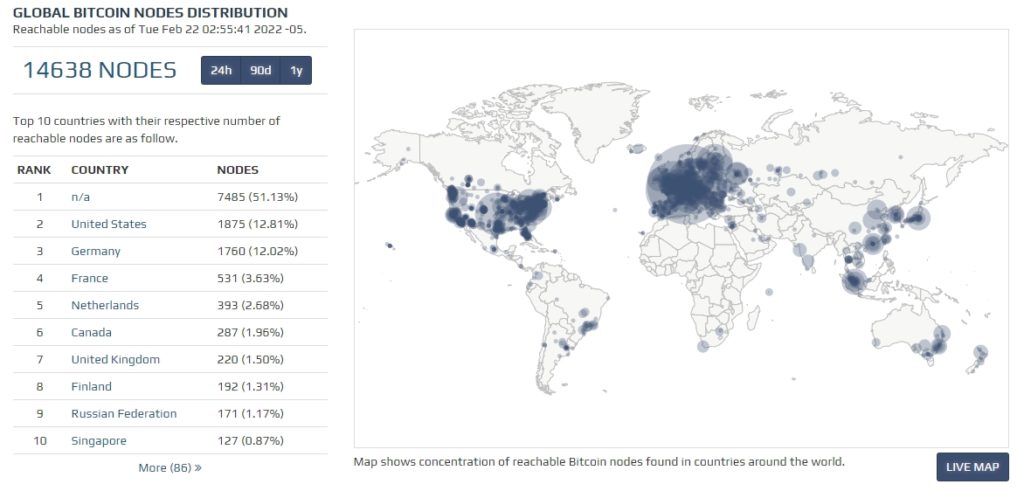

We can’t really identify the origin of all Bitcoin miners. A great portion of them uses privacy tools (like VPNs) to avoid being exposed. The reasons for this are diverse: from not crypto-friendly governments to simple personal preferences. That’s probably why the first “location” (even above U.S. or Russia) in the cited Bitcoin Mining Map is “Other”. And that source isn’t alone. If we check the Global Bitcoin Nodes Distribution, the higher percentage (+51%) is located in “Unknown country”.

What does this mean? As always, anonymity is something valuable inside the cryptocurrency world. Satoshi Nakamoto himself never revealed his real identity, so, why all the Bitcoin miners should do it? Now, considering where the most of Bitcoin hashrate was until 2021, some of that “Other” percentage may be formed by Chinese miners as well.

But not only by Chinese miners. As we’ve mentioned before, if it weren’t for the decisions of their governments, countries like Kazakhstan, Iran, Malaysia, and Venezuela would be more attractive destinations for crypto mining. Perhaps an important percentage of miners have decided to take the risk, even if they have to hide their operations.

Finally, we can say that the “Bitcoin hashrate scale” is balancing. Eastern miners are migrating to Western, but not fully abandoning that region either.

Chcete obchodovat Bitcoin a další tokeny? Můžeš to udělat bezpečně na Alfacash! A nezapomeňte, že mluvíme o tomto a mnoha dalších věcech na našich sociálních médiích.

Cvrlikání * Telegram * Instagram * Youtube *Facebook * Vkontakte