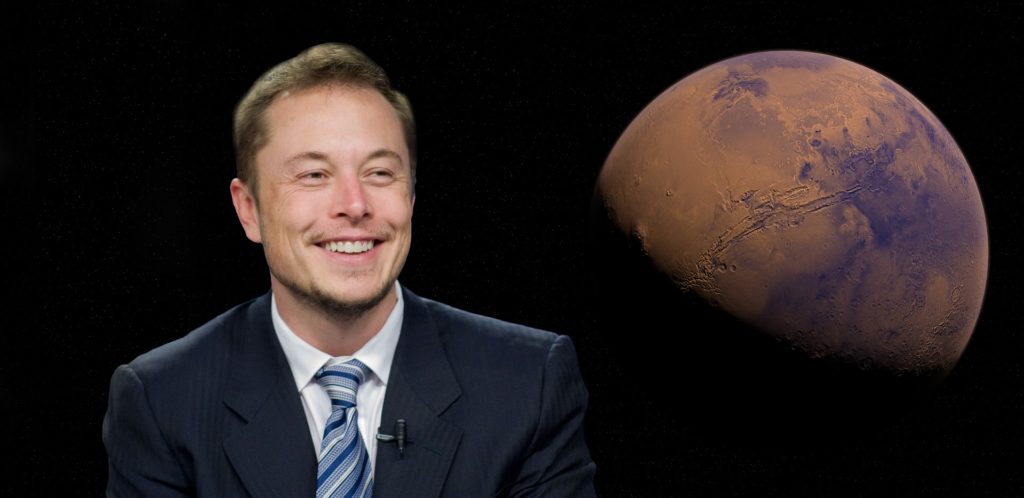

Elon Musk and his electric car company, Tesla Inc., gave a bad surprise to Bitcoin this week. According to the company’s Q2 earnings report, it already sold 75% of its coins (BTC) holdings between April and June 2022. That’s around $936 million from their previous purchase of $1.5 billion in 2021. Likewise, several whales are moving their holdings.

The document alludes to a “Bitcoin impairment”, and how the brand needed the sale to increase the cash on its balance sheet. During the earnings conference call, Musk talked a bit more about the reasons behind the dump.

“We are certainly open to increasing our bitcoin holdings in the future, so this should not be taken as some verdict on bitcoin. It’s just that we were concerned about overall liquidity for the company, given Covid shutdowns in China (…) we’re neither here nor there on cryptocurrency.”

Tesla bought 43,200 bitcoins at a price of around $34,000 per coin. They sold it at an average price of $28,888 per coin. If we consider that 75% of the original coins is 32,400 BTC previously bought at $34,000 ($1.1 billion), but sold at $28,888 ($935.9), then the losses for the company ascend to over $165 million.

This is a sell-off big enough to hit the crypto market. Some people are even blaming Musk and Tesla for the collapse of Terra (LUNA), and the subsequent downfall of Three Arrows Capital (3AC) as well. Of course, this is barely an assumption.

Beyond Tesla, Bitcoin is on the move

After the Bitcoin sale by Tesla, some rumors about the company MicroStrategy (another big holder) selling its Bitcoin too have emerged. Recently, the whale address 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ, rumored to be owned by MicroStrategy, moved thousands of bitcoins to other addresses. There’s no evidence that the coins ended up in an exchange, though.

Blockchain explorers use to tag every publicly known address, especially the ones that belong to crypto exchanges, funds, and similar services. This time, one of the recipient addresses (1LQoWist8KkaUXSPKZHNvEyfrEkPHzSsCd) doesn’t have any tag, and no important outgoing transactions after that one either. It could be a 차가운 지갑. The other address (1FzWLkAahHooV3kzTgyx6qsswXJ6sCXkSR) is also rumored to belong to MicroStrategy itself.

On the other hand, other whales seem on the move as well. As discovered by the analytics firm Santiment, several Bitcoin whales are moving over $1 million per transaction since July 18. “Spikes such as this one can often be a precursor to price direction shifts,” they commented. For now, Bitcoin is in a bullish trend, with +11% in the last week.

That could be what’s called a “bull trap”, though. The Crypto Fear & Greed Index is still in “Fear”. Meanwhile, factors like whales selling their holdings, new possible victims from 3AC, and the European Central Bank’s (ECB) rising interest rates could hit the crypto market again. Only some time can tell.

Bitcoin 및 기타 토큰을 거래하고 싶습니까? 넌 할 수있어 안전하게 Alfacash에서! 그리고 우리가 소셜 미디어에서 이것과 다른 많은 것들에 대해 이야기하고 있다는 것을 잊지 마십시오.