A hedge fund is a high-risk investment financial instrument. These funds are managed by specialized firms or investment banks and offer coverage against market movements. If you are interested in diversifying your investment methods and want to know the top crypto hedge funds, you have come to the right place.

How do the crypto hedge funds work?

Hedge funds pool money from multiple investors to get a better return. Generally, these types of funds require a high minimum deposit. They also carry higher management fees and aren’t as government-regulated as other funds.

Thus, they have greater freedom to use riskier strategies like leverage, short-selling, and other speculative financial instruments among these strategies.

Many top crypto hedge funds focus exclusively on investing in crypto assets, while others also invest in stocks, fixed income, and commodities.

What are the top funds in the crypto market?

Pantera Capital

At the top of our list, we have the first crypto hedge fund to launch in the United States in 2013. Pantera Capital offers investors a variety of options, including hedge capital ventures from the blockchain sector to liquid cryptocurrencies and early-stage 토큰.

According to the company’s website, Pantera Venture Funds have realized $125 million on $23 million invested capital across 26 companies.

Blockchain Fund

One of Pantera’s investment mechanisms is its Blockchain Fund, which invests in venture capital, early-stage tokens, and liquid tokens. It has a minimum investment of $1 million. In addition, it has a 2% fee and a 20% return.

Morgan Creek Capital Management

Morgan Creek Capital Management is another of the top crypto hedge funds that we can find in the United States. Its mission is to integrate alternative and traditional investments, and it offers services to endowments, pension plans, and foundations.

Its investments include seed 블록 체인, AI companies, and crypto assets. In addition, it offers other investment alternatives, such as the Morgan Creek-Exos Risk-Managed Bitcoin Fund, which seeks to reduce volatility through risk management techniques.

Brevan Howard

Brevan Howard Asset Management is one of the largest of our top crypto hedge funds. Recently this fund 높은 $1 Billion among its investors.

It’s one of the best crypto hedge funds, managing investments worldwide, including public and corporate pension plans. Moreover, its mission is to support the development of blockchains, recruitment, and public relations.

Polychain Capital

Polychain Capital is a cryptocurrency-focused hedge fund founded in 2016. It ranks among our top because it has invested in 162 blockchain startups and had $6.6 billion in Assets Under Management (AUM) in March.

Sequoia Capital

Traditional firms also have a place in our top crypto hedge funds. Thus, we refer to Sequoia Capital, an investment company founded in 1972.

Sequoia has invested in technology companies, including Apple, Atari, Cisco, Google, Instagram, Airbnb, Stripe, and Zoom.

In the crypto space, Sequoia has invested in several crypto startups and, in February, 발사 a $600 million fund to invest in tokens.

Best crypto hedge funds’ performance

Despite the crypto winter, the outlook looks favorable for the top crypto hedge funds. Currently, more traditional funds are investing in cryptocurrencies, and new specialized funds are launched on the market.

According to PwC’s 4th Annual Global Crypto Hedge Fund Report 2022, 38% of surveyed traditional hedge funds invest in cryptocurrencies, up from 21% a year earlier.

Furthermore, the number of crypto hedge funds worldwide exceeds 300, with an accelerated growth rate in the last two years. Likewise, the AUM of crypto hedge funds amounted to $4.1B in 2021, 8% more than the previous year.

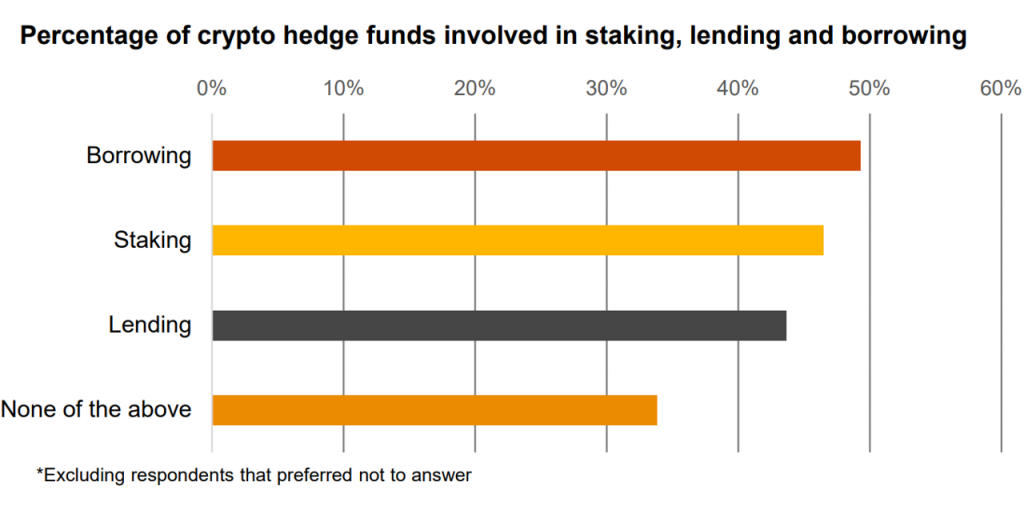

Similarly, crypto hedge funds carry out operations such as lending (44%), 스테이킹 (46%), and borrowing (49%). Also, the survey results point to the number of traditional hedge fund managers who do not invest in digital assets shrinking (62%) from a year earlier (79%).

Main risks of these funds

As you know, every investment carries risk. Thus, even the best crypto hedge funds can surprise their investors and collapse from one moment to another, as happened with one of the most important firms in the industry: Three Arrows Capital (3AC).

Although 3AC had been in business since 2012 and managed billions in assets, as of July 2022, it owed around $3.5 billion to over 32 companies worldwide. The bankruptcy of 3AC was due to the previous collapse of Terra (LUNA) and the unfortunate investments in other tokens that also performed poorly during the crypto winter.

Moreover, investigations pointed to the fund’s founders, Su Zhu and Kyle Davies, embezzling the funds. As a result, the 3AC’s collapse affected millions of victims, and the fund creators received death threats.

For this reason, we invite you to conduct a very exhaustive search before selecting the best crypto funds. In addition, you should consider the pros and cons of taking the kind of risk that crypto funds entail.

BTC, ETH, 그리고 다른 토큰을 거래하고 싶으신가요? 가능합니다. 안전하게 Alfacash에서! 그리고 우리가 이 주제와 다른 많은 주제에 대해 소셜 미디어에서 이야기하고 있다는 것을 잊지 마세요.