The Bitcoin price broke the 20K barrier this weekend as the difficulty for miners also increased. $20K is a significant psychological mark for the bitcoin price. Especially since it is the ATH of 2017. Furthermore, this value has not been seen since November of last year due to the bear market of 2022.

The buying momentum has caused the RSI (relative strength index) to reach its highest level in four years. Despite the good news, this could suggest that a Bitcoin price correction is coming.

An increase in mining difficulty

On Sunday, January 15, the difficulty level of Bitcoin mining had a readjustment that brought this value to 37.59 trillion. This new value is 10% higher than the previous one, which stood at 34 trillion.

As we mentioned earlier, miners found the most recent bear cycle in the Bitcoin price challenging. As a result, some cryptocurrency mining companies filed for bankruptcy last year.

However, the current level of Bitcoin mining difficulty represents a new ATH. This can mean general good news for the miners and the Bitcoin price.

Difficulty expresses how much processing power is required to solve the hash to mine a block. Thus, it is automatically adjusted every 2016 blocks (or approximately every two weeks) based on the power of the miners connected to the network.

Plik processing power of the network, or Bitcoin hashrate, went from 245 EH/s on January 2 to 272.21 EH/s at the time of writing. This increase could be related to the rise in the Bitcoin Price and how many miners returned to profitability and reconnected their equipment.

Historically, increasing difficulty in mining has come hand in hand with higher prices for the crypto asset.

A paradigm shift

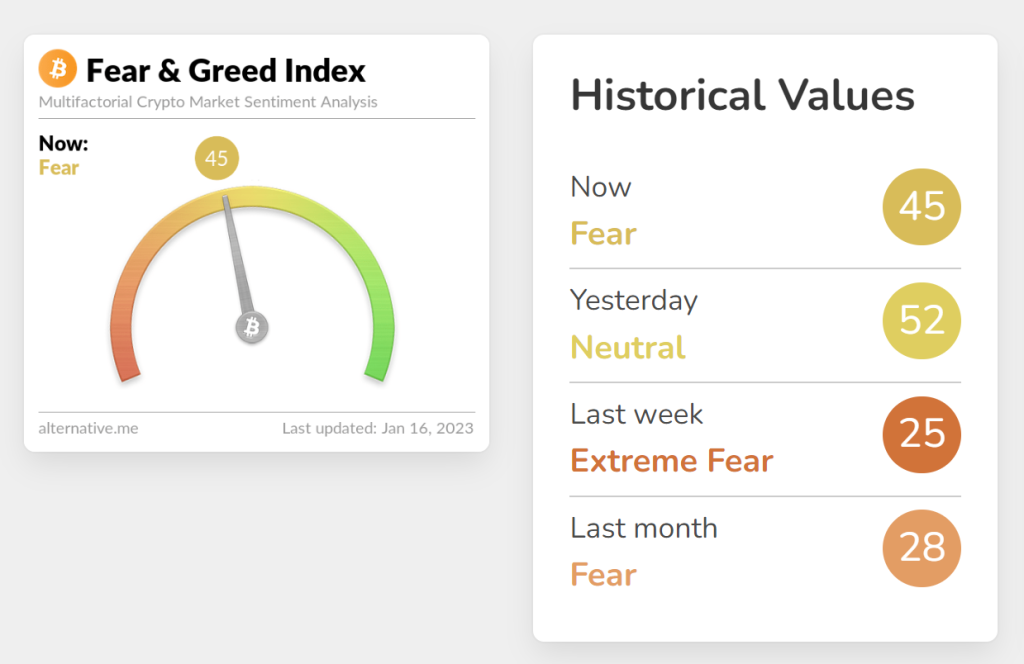

Over the past nine months, overall crypto market sentiment had been low. In 2022, this index recorded its longest streak of ‘extreme fear’ accompanied by the fall in the price of cryptocurrencies.

Jednak, the Fear and Greed Index reached a neutral level of 52 on January 15. At the time of writing, it stands at 45, which stands for ‘Fear’, while Bitcoin keeps hovering around $20,800 [CMC]. This means that despite the fact that the Bitcoin Price has recorded a 24% increase in the past seven days and represents good news for the miners, investors have not yet regained confidence.

Chcę pochandlować BTCi inne tokeny? Możesz to zrobić bezpiecznie na Alfacash! And don’t forget we’re talking about this and many other things on our social media.

Telegram * Facebook * Instagram * Youtube *Świergot