We’re always looking for new and juicy investments around crypto. We already had ICOs, DeFi, and NFTs, so, what could it be the “next big thing”? We can’t know for sure, but since most tokens in this world are fragile and fleeting, we can better pay more attention to those who have remained and succeeded for years. That’s where we have the top 5 coins by market cap.

According to CoinMarketCap (and also other sources like CoinGecko), the top 5 coins by capitalizare de piață sunt Bitcoin (BTC), the first cryptocurrency ever; Ethereum (ETH), the smart contract leader; BNB (previously Binance Coin), another smart contract platform; and the stablecoins Tether (USDT) and USD Coin (USDC).

Currently, they’re the most used crypto coins around, and for good reasons. But do they have any future? What are their next plans and updates? Let’s explore that.

Bitcoin (BTC)

It was released in January 2009 by the mysterious Satoshi Nakamoto. Since then, the first cryptocurrency hasn’t stopped growing. Of course, we’ve had many death omens in the way, including some very ugly price crashes over the years —for several reasons. However, in general terms, Bitcoin hasn’t disappointed.

It has a market cap of over $324 billion and a price of $16,800 per token, making it the most valuable cryptocurrency so far. At this point, Bitcoin is mainstream worldwide, and its adoption is expanding. It’s already mijloc legal de plată in El Salvador, the Central African Republic, Ukraine, and numerous citadels worldwide. So, what can be the next plans for this coin?

You may be surprised, but Bitcoin has over 700 developers and contributors around the world. And they’re still working hard to improve many aspects of the Bitcoin software. On GitHub, where the Bitcoin code lies, you can find 386 Bitcoin Improvement Proposals (BIPs), of which only 43 are active or final. The others are rejected or in process, not to mention that still anyone can send new BIPs for consideration. The main idea, of course, is improving Bitcoin as a blockchain and as a coin.

We can’t talk about every BIP in stock here, but we can mention the next update for Bitcoin: Erlay (BIP #330) by Bitcoin Core. Without diving too much into technical terms, this update will improve the Internet bandwidth efficiency for users and node operators. Therefore, bitcoiners from remote areas with slow connectivity could still use BTC without issues.

Besides, the change will make it harder for an attacker to find out the node from which a transaction originated, increasing Bitcoin privacy as well. Erlay took three years of investigation and testing to reach its final stages. That’s the level of care every BIP receives.

Ethereum (ETH)

Ethereum was released in July 2015, and it’s still the most popular smart contract blockchain. This implies that the most valuable Decentralized Applications (Dapps) live here: ICO-uri, DeFi, NFT-uri, games, and more. According to DappRadar, Ethereum hosts around 3,550 Dapps; including billionaire Platforme DeFi like MakerDAO, Lido, and Curve, and the collectibles CryptoKitties and CryptoPunks.

At the time of writing, Ethereum enjoys its place in the top 5 coins by market cap with over $156 billion and a price of around $1,270 per token. In case you didn’t know, this blockchain even has a huge corporate alliance to develop new things on it, dubbed the Enterprise Ethereum Alliance (EEA). It has over 100 members worldwide, inclusiv giants like Microsoft, Ernst & Young, Accenture, JP Morgan, and Santander.

Of course, we should mention that after long years of waiting, we finally had the transcendental update “The Merge” on Ethereum in September. With it, this chain officially abandoned crypto mining and changed to Proof-of-Stake (PoS). But that’s not all for this platform.

Similar to BTC, the Ethereum development team (comprised of over 1,600 developers) works with Ethereum Improvement Proposals (EIPs) on GitHub. There are around 537 EIPs in total, of which only 116 are living or final. Recently, Vitalik Buterin (Ethereum founder) shared an updated post-Merge roadmap, and they have ahead five more stages at least. On them, they hope to implement features like a speed of 100,000 Transactions Per Second (TPS), quantum-proofness, burnt supply, and limited costs.

Tether (USDT)

This is the most-used stablecoin worldwide, so, it’s the first one of its kind in the top 5 coins by market cap. Founded by Brock Pierce, Craig Sellars, and Reeve Collins, it was released in July 2014. Tether Limited Inc., the firm behind it, is very related to iFinex Inc, the parent company of the crypto exchange Bitfinex. Currently, as indicated by CryptoCompare, USDT is the most traded coin against BTC. It has a market cap of over $68 billion and its price is $1, as it should be.

This stablecoin works on several chains, including Algorand, Avalanche, Bitcoin Cash’s Simple Ledger Protocol (SLP), Ethereum, EOS, Liquid Network, Omni, Polygon, Tezos, TRON, Solana, and Statemine. Nevertheless, unlike those coins, Tether is fully centralized. Its parent company issues USDT tokens when receiving fiat deposits while destroying the same tokens when users redeem them for fiat.

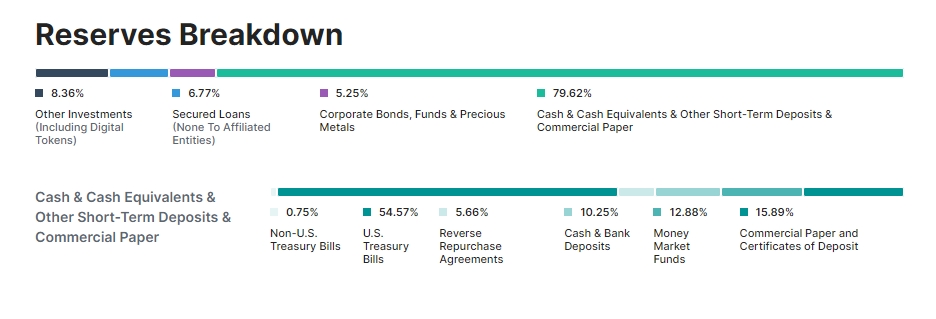

We should mention that Tether has had some polemic issues. They’ve paid almost $60 million in fines to US authorities, which are constantly worried about their reserves. At first, its creators claimed that it was “fully backed” by USD cash on bank accounts owned by the company. However, this isn’t the case now.

More recently, the company a anunțat acea they got rid of all the commercial paper on their reserves and replaced it with U.S. Treasury Bills (T-Bills). They also lansat Pear Credit, “a peer-to-peer credit system that allows issuers to create peer-to-peer credit tokens”.

Meanwhile, the US authorities are still worried about the USDT reserves. By September, a judge in New York asked the company to produce financial records about it. Apparently, as a part of an old lawsuit implying that Tether and Bitfinex caused damages for $1 trillion. The team alleged that this barely was a “routine discovery” by the authorities, though.

BNB (BNB)

Previously Binance Coin, BNB was launched in July 2017 as a token on Ethereum by the crypto exchange Binance. It was moved to its own blockchain, the Binance Smart Chain (Now BNB Chain) in 2020. Since then, given the much lower fees, it has gained a lot of ground against Ethereum. For DappRadar, this is the chain with more Dapps: they counted around 4,311 from all categories.

BNB currently has a market cap of over $46 billion and a price of $288, securing a strong position in the top 5 coins by market cap. Nevertheless, we can’t really say it’s the safest chain. Over 1,400 of the mentioned Dapps are classified as “High-Risk” when Ethereum only showed 511 in this category. Besides, according to DeFiYield, BNB Chain has been the favorite blockchain for hackers and scammers for several months now.

Centralization might be another issue there. BNB claims to be fully decentralized and controlled by its community and validators (in a PoS system). But, from 44 validators in total, only 26 are active. There’s only one developer on its GitHub, although Artemis Stats counts at least 74. Given these numbers and the fact that the chain was halted so easily after its last hack, the community is now concerned about its dubious decentralization.

Beyond this, at least, they have a lot of plans and projects running. Their version of BIPs is the BEPs (BNB Evolution Proposals). It’s possible to find at least 26 different BEPs on GitHub. They’re also introducing more technical features like parallel EVM (to improve transaction performance) and native oracles (to connect with data off-chain). Outside the programming itself, BNB is organizing events and grants constantly, like its European Innovation Incubator.

Last May, the team shared their tech roadmap 2022 as well. The expected innovations include faster transactions, lower costs, further decentralization, and more sidechains to interconnect different ecosystems.

Moneda USD (USDC)

USDC is the second stablecoin by market cap, with over $43 billion, and is also pegged to the USD. It was launched in 2018 by the US company Circle, which claims to be fully regulated. A factor to prefer this coin over USDT could be their reserves and transparency, even if not everyone is convinced of this. As it reads on their official website:

“Known as a fully-reserved stablecoin, every digital dollar of USDC on the internet is 100% backed by cash and short-dated U.S. treasuries, so that it’s always redeemable 1:1 for U.S. dollars (…) Circle is regulated as a licensed money transmitter under U.S. state law (…) Circle’s financial statements are audited annually and subject to review by the SEC.”

Clearly, just like its peer, USDC is fully centralized. Circle controls its supply, and we can say that US authorities control Circle. So far, this coin runs on eight blockchains: Ethereum, Solana, Avalanche, TRON, Algorand, Stellar, Flow, and Hedera, “with more native integrations expected this year and beyond.” About this, indeed, au anuntat that the next chains will be Arbitrum, Optimism, Near, Polkadot, and Cosmos.

They’ll also launch a Cross-Chain Transfer Protocol to move USDC natively across different chains. It’ll be live first for Ethereum and Avalanche this year, while more activations are expected for 2023. In addition, they’ve just received regulatory approval to operate in Singapore.

Top 5 coins by market cap aren’t always the same

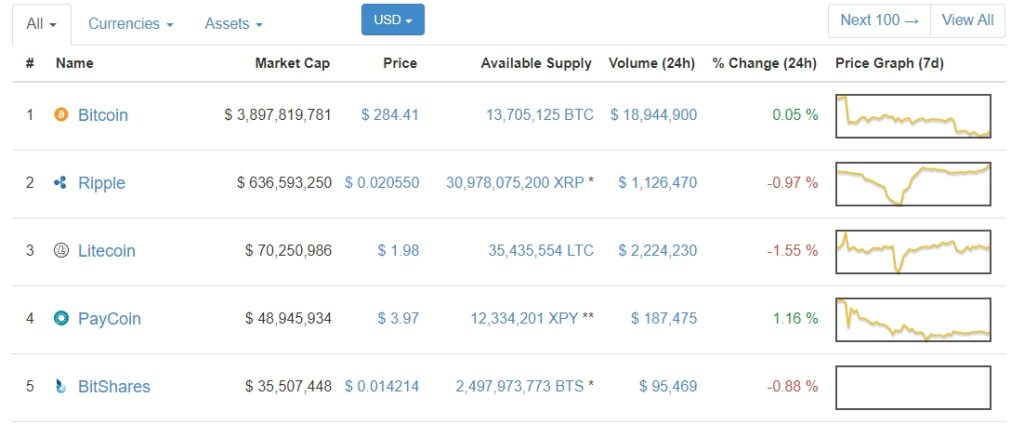

We must consider that crypto is a very changing environment. By 2015, for example, these same top 5 coins by market cap were totally different. Except for Bitcoin, always in the first place, the other coins in the list back then lost their positions, are barely here now, or they’re simply gone. Ethereum wasn’t even in the top 10.

Ripple (now XRP) and Litecoin (LTC), second and third places in 2015, seem to have stood the test of time, albeit descending on the top —to 6 and 18, respectively. PayCoin (XPY), fourth in 2015, didn’t survive. BitShares (BTS), the fifth in 2015, descended to #468 by market cap now.

Therefore, the leaders we see today may not be the same in the future. That’s why it’s important to do your own research (DYOR) about every project, and always keep up to date with them. Things and coins change!

Wanna trade BTC, ETH, USDT, and other tokens? You can do it în siguranță pe Alfacash! And don’t forget we’re talking about this and many other things on our social media.

Telegramă * Facebook * Instagram * YouTube *Stare de nervozitate