The odds haven’t been too kind for Bitcoin mining companies lately. Or the previous year. The bear market was especially harsh on them, erasing a lot of their profitability. Sadly, some of them didn’t save enough “provisions” for the winter. On the contrary, they took millionaire loans to expand their operations in 2021, and now they’re paying the price for it.

Last year, we saw how numerous crashes and bankruptcies hit the whole crypto market very hard. Terra (LUNA) was only the first (big) one. Three Arrows Capital (3AC), Celsius, Babel Finance, Voyager, BlockFi, and, of course, the infamous FTX exchange are on the blacklist. Is it now the turn of the corporate miners?

Currently, a Bitcoin block rewards miners with 6.25 BTC (around $112,000) every ten minutes or so. Plus, they also keep the transaction fees: at despre 0.08 BTC per block ($1,440). On average, 144 blocks are mined daily. If we add and multiply the previous values, we’ll get a total of 911.52 BTC ($16.4 million) produced daily —and 27,345.6 BTC ($492.2 million) produced monthly.

To sum it up: it’s an industry with a lot of money to offer. Bitcoin mining companies have it easy, right? Well, not exactly.

Bankrupt Bitcoin mining companies in 2022

At this stage, to produce Bitcoin is necessary to spend a lot of money on energy, specialized machines, and proper facilities (not to mention legal issues). Solo miners exist, and also mining pools for working as a team with others. But they rarely are able to get paid the full rewards. Only big miners (corporate actors) can keep the whole thing, and they also have to pay for it.

In a bullish market is easy for everyone to thrive. That’s why a lot of companies got indebted to acquire more machines and increase their earnings. However, the bills to pay didn’t disappear in the bear market. During 2022, at least two Bitcoin mining companies filed for bankruptcy: Compute North (September) and Core Scientific (December).

The first one owes $500 million to 200 creditors while keeping assets between $100 and $500 million. Maybe the worst part is they used to provide hosting services to other mining companies, including Marathon Digital Holdings and Compass Mining. So far, they don’t seem affected by it, though.

Compute North is trying to restructure and stabilize itself under bankruptcy protection. That’s also the case with Core Scientific. This is the world’s biggest publicly traded Bitcoin miner, with about 10% of the total Bitcoin hashrate. According to the filing, they have around $1.3 billion in liabilities to 5,000 creditors, and assets for $1.4 billion. And they already reached agreements with most of their creditors, securing space for a restructuring.

Bitcoin mining companies with the highest debt

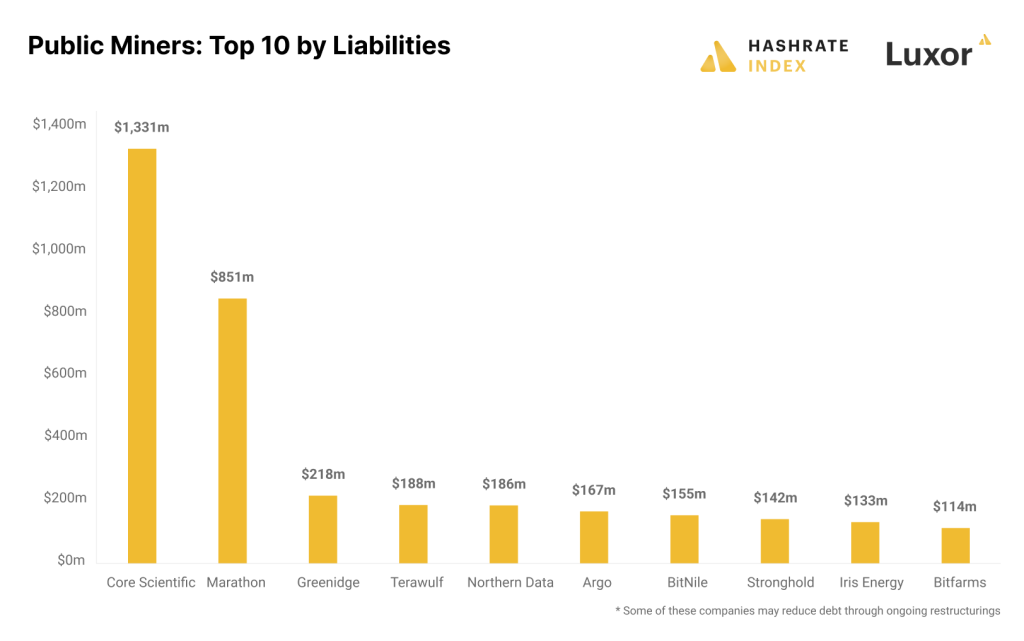

Two bankrupt miners aren’t the end of it. Several firms are at bankruptcy risk at this point, and their debts are huge. As described by Hashrate Index, “the public Bitcoin mining companies collectively owe more than $4 billion.” That includes the debts by Compute North and Core Scientific, but also others than haven’t gone bankrupt —yet.

In second place by the owed amount (after Core Scientific) is Marathon Digital Holdings, with over $851 million. Previously, they invested around $80 million in the now-bankrupt Compute North, which worsens the situation.

However, their debt payment could be easy to achieve. As explained by Hashrate Index:

“Most of this debt is convertible notes, which come with no monthly debt service payments but instead give the holders the option to convert them to stock. Therefore, Marathon’s debt is relatively easy to service, and the company is not at immediate risk of going bankrupt.”

The third largest debtor is Greenidge. They owe around $218 million but got a debt restructuring deal with its lender, NYDIG, in December. The voluntary bankruptcy filing is still on the table, though. The firm Argo is considering it as well, with a debt of at least $187 million. They already had to sell their mining facility Helios for $65 million, but they’re still operating on it.

Other brands with over $114 million in debt include Bitfarms, Iris Energy, Stronghold, BitNile, Northern Data, Riot, and Terawulf. Nevertheless, “debt” doesn’t necessarily mean danger. Indeed, most of the mentioned companies have solid balance sheets (with payments up to date), or have reached deals to restructure their debt.

So, what happens next?

The whole picture, as we’re seeing, isn’t that dire for now. We already mentioned the Bitcoin mining companies with issues, but it’s important to note that there are also firms in good financial health. CleanSpark, Riot, Hut 8, Bitfarms, Hive, Northern Data, TeraWulf, Compass Mining, Bit Digital Inc. and Bit Mining Limited reported good or neutral results for Q3 2022.

Despite the debt deals and some potential bankruptcies ahead, the miners still have a billionaire industry to thrive. For Hashrate Index, the Bitcoin hashrate growth will slow down this year, as public miners will merge with others, turn private, or reduce their facilities/stocks. That could be positive for miners’ profitability, and would likely have a light impact on the network.

Conform Crypto Oxygen, publicly listed miners only control about 17% of the total hashrate. Even if they all disappear, the effect on Bitcoin performance wouldn’t be that hard. Now, we can talk about a potential hit against the whole crypto market (like Terra or FTX did).

Bitcoin price concerns

Of course, a row of bankruptcies wouldn’t be positive. Beyond the FUD involved, these companies own large amounts of BTC. A bankruptcy filing could imply the partial or total liquidation of these assets, causing a potential blow to the Bitcoin price. To date, Marathon, Hut 8, Riot, Hive, Bitfarms, Argo, and Bit Digital collectively own around 35,322 BTC ($635.7 million) —as reported by Bitcoin Trezorerie. We can tell it’s a large amount, but maybe not enough to make significant damage by itself.

The creditors involved (5,000 of Core Scientific, for example) could be another serious issue in the future. We’ve already seen a bad crypto contagion after 3AC and FTX couldn’t repay their debts. Luckily, this doesn’t seem the case now. The miners are already reaching agreements, selling some assets, and restructuring to make it in the long term.

If the market turns bullish, as it seems so far, the added help would be enormous. Bitcoin has recovered $18,000 per token, and the whole market cap has gained 8.5% in the last week [CMC]. For now, a potential crypto mining disaster seems evitable. Let’s just be careful, wait, and see.

Wanna trade BTC, ETH, USDT, and other tokens? You can do it în siguranță pe Alfacash! And don’t forget we’re talking about this and many other things on our social media.

Telegramă * Facebook * Instagram * YouTube *Stare de nervozitate