Bitcoin (BTC) closed August with losses. BTC has lost 70% in its price since its ATH last November. However, the number of entities holding 0.1-1 BTC has grown faster than at the end of the 2017 bull market. Today we will talk about who are the Bitcoin shrimps and how they increased in the past few months.

The ravenous appetite of Bitcoin shrimp

In crypto, shrimp refers to entities with less than 1 BTC in their wallets. As a result, shrimps rank near the bottom of the hierarchy in the Bitcoin food chain. They are just above plankton, the last species of crypto organisms with less than 0.05 BTC.

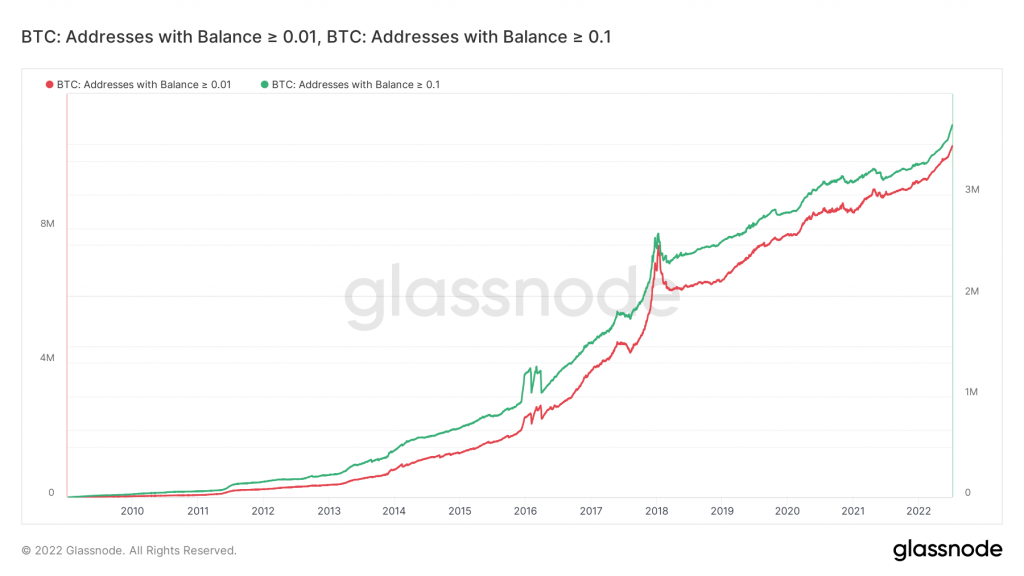

By July, the number of BTC retail investors was above 2017 values. So, the number of addresses holding less than 1 BTC reached its all-time high.

Since 2021, the number of addresses with more than 0.01 (red) and 0.1 (green) BTC has increased rapidly. Also, despite the bear market, there was no significant decline in these directions.

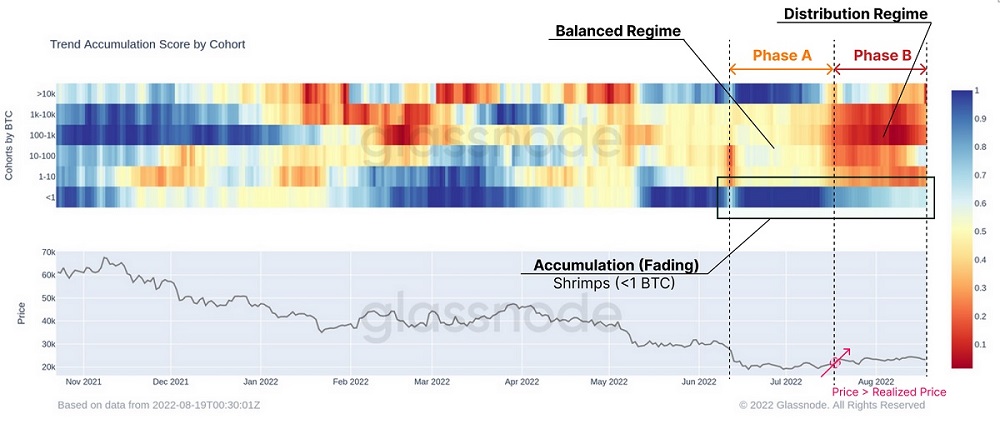

Accelerated buying by retail Bitcoin investors was typical behavior of bullish seasons. Thus, when the Bitcoin shrimps added 60,400 BTC to their wallets in June, everything seemed to indicate that the crypto winter would be very short-lived.

However, this trend has ebbed recently, with whales returning to asset sales.

August: a twist for Bitcoin shrimps

Every marine animal must eat, and the Bitcoin shrimp is no exception. According to Glassnode data, the BTC investors are taking profits during this bear rally. So, they are spending coins at their base cost to simply “get their money back”.

Likewise, a decline in transaction activity with volumes below $10,000 exhibited the weakness of Bitcoin’s latest rally to $25,000. Unfortunately, Bitcoin shrimps are investors highly influenced by the moods of greed and fear.

Thus, FOMO becomes the wind rose of BTC retailers, and they fear a possible catastrophe. In this regard, there have been no significant reasons for new players to enter the crypto market.

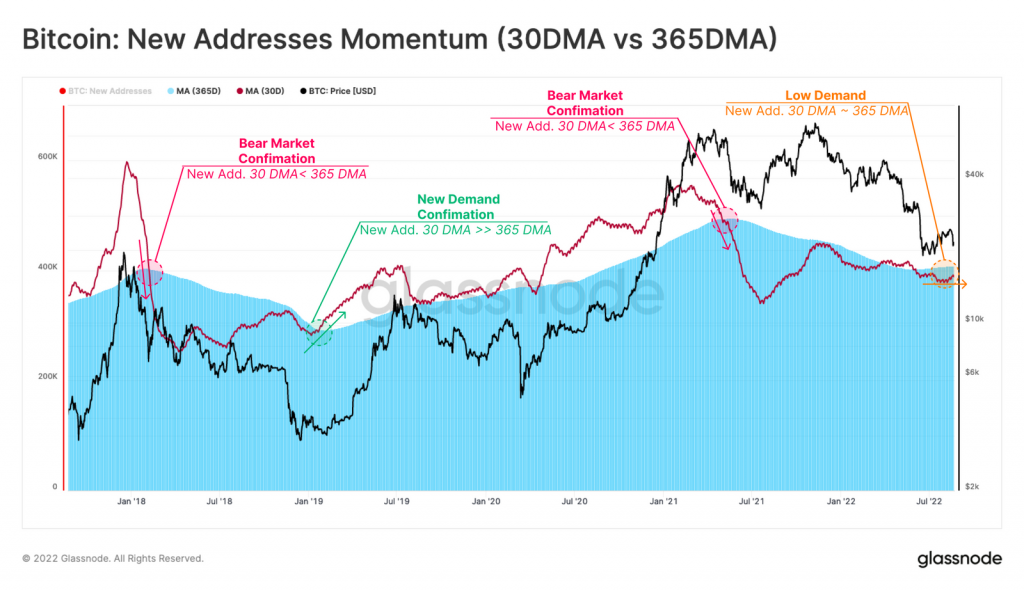

One of the determining factors of price growth is the increase in activity and the appearance of new addresses. Currently, the monthly average of new addresses is below the yearly average, indicating low activity.

There are more Bitcoin hodlers outhere

However, the sale by retailers and the low activity from new investors has not been an impediment for Bitcoin traders to continue accumulating coins. Thus, the hodler balance reached a new high of 12.92 million BTC in August. Furthermore, almost 60% of BTC has been held in the same addresses for over a year.

According to IntoTheBlock, the accumulation in this bear market reflects the long-term high expectations that many Bitcoin hodlers have for the cryptocurrency’s price.

Similarly, many bitcoin shrimps have accumulated their coins to reach 1 BTC. The number of addresses holding between 1 and 10 BTC set another all-time high, approaching 750k [IntoTheBlock].

The accumulation tendency score is a much better on-chain indicator than the Fear and Greed Index, which at the time of writing sits at 28 (Fear).

Also, since March, the whales have begun to accumulate Bitcoin. Wallets with more than 1,000 BTC (purple) and 10,000 BTC (yellow) have increased considerably since March. Therefore, large investors began accumulating assets significantly since the market correction in March.

Who do Bitcoin retailers buy from?

As the number of holders increased, bitcoin shrimps no longer bought from them. Instead, they started purchasing the горняки, who had capitulated for the last three months.

By 2017, entities up to 1 BTC accumulated 49% of the supply provided by miners. In July 2022, it was up to 75%.

The 30-day and 60-day averages of Bitcoin network processing (the short- and medium-term miners’ computing power) cross to determine whether or not miners are capitulating. If the miners stop capitulating, then this is a strong bullish sign.

Or at least that is how some analysts consider it. They believed that the capitulation of the miners officially ended on August 20, so the price of BTC would begin to rise. However, the Bitcoin price for the last days of August, which stands at $20,180 [CoinMarketCap], seems to indicate otherwise.

Long-term holders are a stabilizing factor

The data also shows that Bitcoin Hodlers, who have held their funds for more than two years, didn’t fret about the august relief rally. The only time long-term holders succumbed to market pressure was in June when the Terra (LUNA) crash pushed everyone to sell.

Тем не мение, long-term holders remain firm as the market enters its third month of recession, with the expectation of further tightening monetary policy by the Federal Reserve.

Wanna trade BTC and other tokens? You can do it safely on Alfacash! And don’t forget we’re talking about this and many other things on our social media.

Телеграмма * Facebook * Instagram * YouTube *Twitter