The blockchainBlockchain is a type of database storing an immutable set of data, verifiable to anyone with access to it —through... is the safest place to keep your funds, but it may have a critical vulnerability: yourself. In the cryptocurrencyA digital currency running on a blockchain and built with cryptography. Contrary to central-bank issued currency, cryptocurrency issuance rules are... More world, you’re mostly the one and only in charge of your own money, and sometimes malicious people out there take advantage of it to make you transfer them your cryptos in exchange for nothing.

When someone deceives you in some way to take your money, that’s called a “scam”. If the fraud involves cryptocurrencies, we can call it a crypto-scam. And, sadly, the scammers inside the cryptocurrency world and their creativity are almost endless. There’s also hackers and malware, but that’s another story.

Let’s know here some of the most common crypto-scams and how to protect yourself from them.

Magical trading

“I will teach you how you can earn $2,500 bitcoinBitcoin is the first decentralized digital currency. It was created in 2009, by an anonymous founder or group of founders... More everyday all directly inside your walletA crypto wallet is a user-friendly software or hardware used to manage private keys. There are software wallets for desktop... More, with a legit and a guaranteed stuff (…) Earn $20,000 in 5 days (…) Giving out info to first 60 serious persons that inbox me”.

Does it sound familiar? You’ve probably seen it already (and multiple times) on Facebook and other social media. The method is simple: an unknown person makes that extraordinary offer in some group, promising high returns for small investments. How’s that? We don’t know. We always should ask directly for a private message.

But wait, let’s check another one:

“Last week, he [some celebrity, no matter who] appeared on [some local show] and announced a new “wealth loophole” which he says can transform anyone into a millionaire within 3–4 months. [The celebrity on duty] urged everyone in [the target country] to jump into this amazing opportunity before the big banks shut it down for good”.

This is the typical announcement that the magical trading platform Bitcoin Billionaire (also known as Bitcoin Evolution, Bitcoin Era, Bitcoin Compass, etc.) uses to promote itself. The mentioned celebrities never said that anywhere, but isn’t difficult to make it up in a text.

Somebody will be always there to propose some kind of magical business/platform or automatic cryptocurrency trading, to make huge quantities in no time and for just a small initial investment. However, they only want your cryptos, and they’ll never give you something in return. There’s no magical trading and easy money! Be skeptical.

Fake ICOs

As we’ve discussed before, an Initial Coin Offering (ICO) is a mechanism of fundraising in which a company, organization, team, or individual (anyone, really) offers to the public an established quantity of new blockchain-based tokens for sale in a given period.

They can be legitimate and the devs might deliver awesome products at the end (like happened with Ethereum, EOS, or Filecoin). But they can also be a huge scam, designed and promoted to steal the people’s real cryptocurrencies.

Luckily, some factors always give them away. A fake ICO usually has little or no documentation at all. If they have a white paper, is very probable that it’s poorly written and doesn’t specify the actual operation of the product; only focusing on how amazing is blockchain technology in general.

Anonymous team, aggressive marketing (sometimes, involving celebrities), and too-good-to-be-true promises are also part of the recipe. If they offer you 40% of monthly (and inexplicable) returns thanks to their new-created-token, just run away ASAP. That’s exactly what the infamous scam Modern Tech did in Vietnam before disappearing with all the money.

Fake giveaways

By now you must’ve heard about the last Twitter hack, where the accounts of high-profile people and companies (including Bill Gates, Elon Musk, Apple, and Uber) were hijacked for a while. In that opportunity, a message like this appeared on their accounts:

That’s indeed typical: send me $1,000 and receive back $2,000 in Bitcoin. Before the Twitter hack, these kind of messages appeared regularly in phishing accounts, where you could spot a different handle from the original. But the extraordinary promise was the same.

Of course, if you send those $1,000 (or anything), you only will receive a huge disappointment in return.

Imaginary Cloud Mining

The so-called Cloud Mining might be a legitimate system, but it’s often used just to scam people. It’s a method where a company asks for money to buy cryptocurrency miners (specialized machines) and build and maintain some mining farms. When these machines start to produce cryptocurrency, the earnings are shared with the investors, usually every month.

Although, there’s a thing. Cloud Mining webpages are all around the Internet, offering contracts to anyone for a small investment and promising guaranteed returns for the mining, without having to worry about the configuration and maintenance of the equipment. This might be true, but it might be fake as well.

Before investing in Cloud Mining, you should research thoroughly the company behind the product. They should have real evidence about the owning of the machines and its performance, including photos, videos, and figures registered on the blockchain. If they can’t provide those simple things, they’re probably a scam.

Pyramid schemes

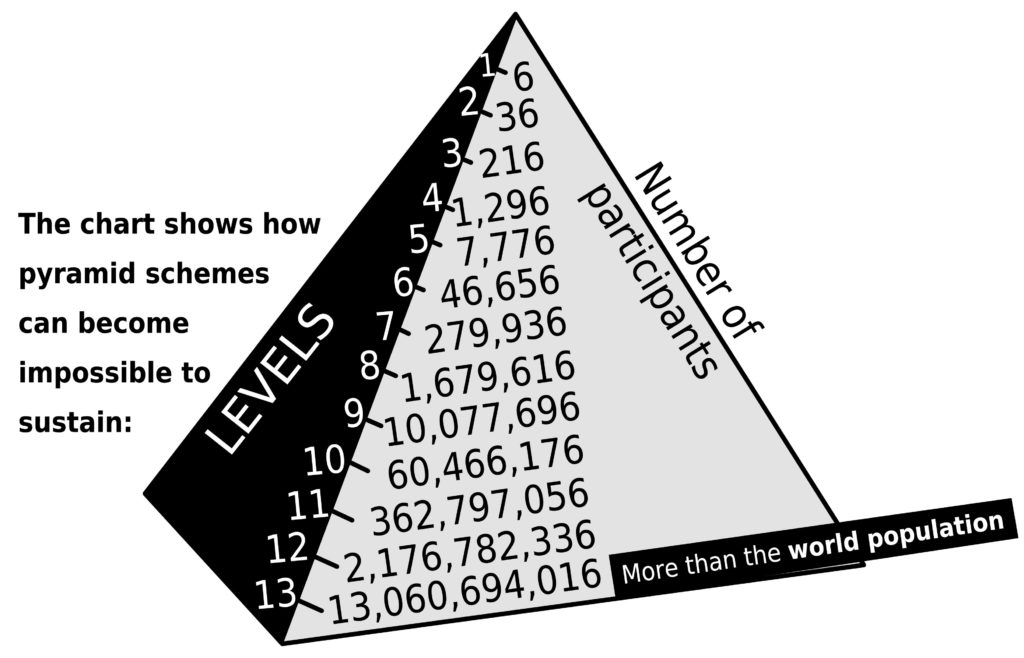

The referral system is always a sign of a pyramid/Ponzi scheme. Someone asked you to get into a new amazing project with cryptocurrencies, where you can earn some percentage for every person you bring to join and invest in the platform? Scam alert!

A pyramid scheme doesn’t offer any real product but instead is just waiting for new investors to pay the promised percentages to the oldest ones. When there are no more enough new investors, then the pyramid falls and the admins flee away with the rest of the money.

In the cryptocurrency world, these scammers use to mix this fraudulent structure with a fake ICO, a fake token, some magical trading, or imaginary cloud mining. They feign to have a real product, but they don’t: their only source of revenue is the referrals.

We should note that the referrals systems in other circumstances are legitimate. For example, a company (with a real product, like a crypto-exchange) can offer that program as a bonus to their customers. But, in those cases, the referral systems are only an additional benefit, to attract more customers to use their product, not the real source of revenue for the company.

Inflatable cryptos

Sometimes, the cryptos (and also the stocks) are like balloons: they can be inflated… and then punched and discarded. That’s known in the financial world as a “pump-and-dump schemes”. They happen when a group of people coordinates themselves to buy in the same period a lot of some token (usually new or not well-known).

In that way, they manage to increase the price artificially, to sell it more expensive later (also at the same time). When this massive sell-off happens, the price of the token plummets again, and the people that were attracted by FOMO (Fear of Missing Out) and bought it at the highest value, lose their investment.

This happens often with some less-known altcoins, but now it’s been practiced especially with some new DeFi tokens. The fever for yield farming fed, in a matter of hours, tokens like PIZZA, HOTDOG, and KIMCHI just after their launch.

They reached very high prices (like $6.000+ for HOTDOG), but it didn’t long last: in only a couple of hours, the price dumped to sub-dollar levels, and the next day they were all dead. Like a punched balloon, yes. That’s why it’s not advisable to invest in tokens which price suddenly surged without explanation.

Don’t fall for it!

- Learn as much as you can about the platform you’re interested in, and research it in detail, including third-party reviews.

- Don’t believe in the first sights. Look for evidence. They can be promoted by the Pope and regulated by Central banks, but, really are they?

- Never show to anyone, under no circumstance, the private keys of your wallets.

- If you’re new in the cryptocurrency world, use only the widely known (and regulated) services. Don’t let greed guide you.

- If someone needs to assure you that they’re trustworthy and their product/service is 100% real no fake, then it is fake.

- All that glitters isn’t gold: be skeptical.

Wanna trade BTCAn abbreviation for Bitcoin., ETH, and other tokens? You can do it safely on Alfacash! And don’t forget we’re talking about this and a lot of other things on our social media.

Twitter * Telegram * Instagram * Youtube *Facebook * Vkontakte